Even without the Reserve Bank of India (RBI) lowering the repo rate, the lack of lending opportunities in a sluggish economy is forcing banks to resort to heavy undercutting with the result that even AA-rated corporates are able to borrow at base rates.

RK Goyal, executive director, Central Bank of India, confirmed to FE the competition had resulted in his bank lowering rates. ?Since there is no credit offtake, we?re lending to AAA- and even AA-rated companies at the base rate. That way we are at least sure of the credit quality,? he said.

BB Joshi, ED at Bank of Baroda, said that while it wasn?t the norm to lend to AA companies at the base rate, the bank had been doing so on a ?case-to-case basis?.

The other reason banks have dropped rates is that the commercial paper (CP) market has turned somewhat illiquid after the government changed the tax treatment for income schemes of mutual funds. Banks are now hesitant to buy CPs since they are unsure of an exit with mutual funds now participating to a smaller extent in the market.

Mohan Shenoi, president, group treasury and global markets, Kotak Mahindra Bank, said that with MFs having reduced their activity in the CP market, both liquidity and rates had turned volatile, making it difficult to price CPs. ?Moreover, the FII limits for CPs are full and there is no room for them to invest,? Shenoi pointed out.

State Bank of India (SBI) chairman Arundhati Bhattacharya told FE in an interview last week that almost all banks were quoting base rates for AA accounts since liquidity was ample and credit growth slow. ?It?s not just SBI that?s lending at base rates, many others are too,? Bhattacharya said.

Lending at the base rate and giving up the spreads need not always be a complete loss because some banks earn more by way of fee income. VR Iyer, CMD, Bank of India, pointed out that by lending to the navratnas at the base rate, the bank managed to earn more fees.

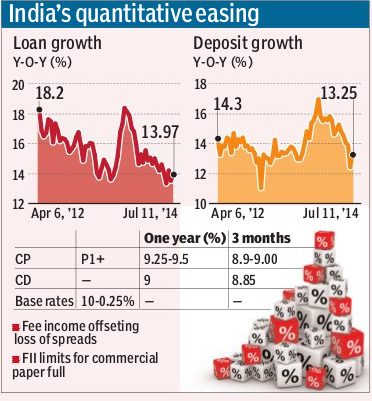

Loan growth has been subdued over the past few months at just around 14% year-on-year. In several fortnights, the growth in deposits has been higher than the loan growth ? averaging 14.5% ? and as such bankers have had access to a fair amount of liquidity.

Outstanding non-food credit at the end of July 11 was Rs 60, 07,685 crore, while outstanding deposits stood at Rs 79, 96,060 crore. Indeed the statutory liquidity ratio, the amount that banks invest in government securities as a share of their net demand and time liabilities, is way above the mandated limit of 22.5% and estimated at over 25%.