Retail loan book to show 17% annual growth over the next two years

Mortgage growth to remain buoyant: Based on our bottom-up analysis of the physical property market and the IT sector indicates, retail loan book would grow at a CAGR (compound annual growth rate) of 17% over the next two years. Over the past five years, the loan book of housing finance companies (HFCs) has grown at a CAGR of about 22%, primarily driven by Tier-I and Tier-II cities. We believe mortgage financing in India could witness a CAGR of about 18-19% over the next two years. Further, we have tried to cross-check the housing market CAGR by analysing IT sector employee growth, which forms about 25% of total demand. Based on our IT sector analysis, we expect a loan CAGR of at least 15%.

Competition unlikely to impact NIMs or market share: In spite of increasing competition, we do not expect any compression in NIM (net interest margin). HDFC?s NIM, for example, has remained stable over the past five years despite intense competition, and the company did not have to compromise on market share to achieve that. Further, an analysis of banks base rate and lending rates indicate there is no major room for banks to cut mortgage rates.

Competition unlikely to impact NIMs or market share: In spite of increasing competition, we do not expect any compression in NIM (net interest margin). HDFC?s NIM, for example, has remained stable over the past five years despite intense competition, and the company did not have to compromise on market share to achieve that. Further, an analysis of banks base rate and lending rates indicate there is no major room for banks to cut mortgage rates.

Also, in case of LIC HF, we expect NIMs to increase as a majority of the fixed rate loans will be transferred to high-yield floating rate loans over the next 20 months. LIC HF also plans to increase non-individual loan (300-400bp higher) contribution from current 5% to 8-10% of the total loan book in next two-to-three years.

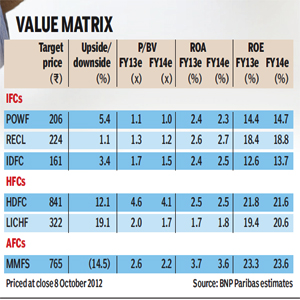

Superior asset quality warrants premium valuations: We compare asset quality of HFCs to that of other finance companies (infrastructure, auto and gold loan companies) and believe that HFCs have the lowest asset-quality risk. We have compared various segments on asset quality (volatility in asset prices, life of the asset, resale value), borrower profile (background, purpose of borrowing and visibility of the borrower?s future cash flows) and other important lending parameters, such as loan-to-value (LTV) ratio and historical non-performing assets (NPA). We expect the NPAs of HFCs to remain under 1%, whereas there could be an increase in the NPAs of IFCs and AFCs (infrastructure/ auto financing companies).

Superior asset quality warrants premium valuations: We compare asset quality of HFCs to that of other finance companies (infrastructure, auto and gold loan companies) and believe that HFCs have the lowest asset-quality risk. We have compared various segments on asset quality (volatility in asset prices, life of the asset, resale value), borrower profile (background, purpose of borrowing and visibility of the borrower?s future cash flows) and other important lending parameters, such as loan-to-value (LTV) ratio and historical non-performing assets (NPA). We expect the NPAs of HFCs to remain under 1%, whereas there could be an increase in the NPAs of IFCs and AFCs (infrastructure/ auto financing companies).

HFCs are the best way to invest in Indian real estate: We believe HFCs are the best way to invest in Indian real-estate, as HFCs eliminate asymmetric risks. The sector is plagued by asymmetric risks?such as corporate governance, project dependence on government approvals and limited exposure to Tier-II cities (which are expected to grow faster than the Tier-I cities due to increasing urbanisation in India). We prefer real estate stocks over HFCs for investors wanting to take advantage of the asset appreciation cycle which we believe is still some time away.

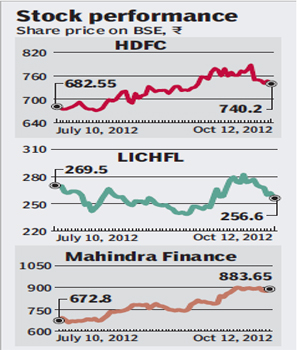

What if analysis indicates a balanced risk-reward scenario: In spite of the recent run up (HFCs outperformed the Sensex by 20% YTD), our what-if analysis of the housing finance companies indicate balance risk reward ratio. In a bull case (loan growth of 25%), upside could be as high as 20-30% whereas in a bear case (loan growth of 15%) downside is about 10-20%.

We initiate coverage of HFCs; we have an ?Improving? view on the diversified financial sector: We initiate coverage on the HFCs and we have a positive outlook on the segment. We expect key operational data for HFCs to remain strong. We prefer HFCs of all the diversified financials we cover IFCs, HFCs and AFCs. AFCs are our least preferred. Among the HFCs, LICHF is our top pick.

HDFC: We upgrade HDFC to Buy (from Hold) and raise our target price to R841 (from R681), due to a change in the valuation methodology. We believe concerns about market share loss and NIM contraction are unwarranted. We prefer HDFC to HDFC Bank over the next couple of quarters. We believe potential moderation in wholesale rates, an improvement in housing demand and positive sentiment related to the recent hike in FDI limit in insurance are key catalysts.

We initiate on Mahindra Finance with a Reduce rating. We believe, current valuations factor in all the positives and leave little room for any negative surprises (higher NPAs due to the subdued monsoon and a slower loan growth due to softening of tractor demand in rural India). MMFS currently trades at 2.6x 1 standard deviation above historical mean.

BNP Paribas