Slight beat; outlook subdued: Hero Motocorp reported Ebitda at Rs 6.2 bn in Q2FY14 versus our expectation of Rs 5.5 bn led by higher-than-expected spare part sales and better-than expected product mix. Cost pressures were also subdued this quarter as suppliers were not given price hikes during the quarter. We expect volume growth to remain subdued and don?t see any major levers for Ebitda margin expansion. We maintain our Reduce rating on the stock as we believe the stock is fairly valued at this juncture.

Sequential improvement in average selling prices surprises positively: Hero Motocorp reported net sales of R57.3 bn (10% year-on-year), which was 3% above our estimates, driven by better-than-expected spare part and scooter sales. Average selling prices improved by 2.4% q-o-q despite no price hike taken in the quarter, which the management attributed to better-than-expected spare part sales. Retail volumes grew by 7% y-o-y in H1FY14 driven by decent growth in rural volumes but we expect volumes to remain subdued in H2FY14. Management was not very bullish on volume growth and expected a low single-digit growth.

Cost savings will determine stock price movement: The management highlighted its cost-saving target of achieving R15 bn of annual savings by FY17-18, which could boost Ebitda margin by 500 bps. The key areas of focus are?(i) localisation of components and (ii) savings on freight costs. The key component that is imported is alloy wheels, which form 5.5% of net sales, from China. Bajaj Auto imports these wheels from China because it helps in cost savings versus setting up domestic capacities. While we believe cost savings of R5 bn can be achieved if the company localises 10% of its imported content, the cost savings will take time and could be passed on as competition intensifies in the sector. By FY17-18, Honda would have doubled its distribution reach from current 2,500 touch points, which will limit Hero?s ability to increase prices to offset rising input costs.

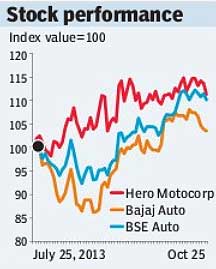

Maintain Reduce with target price of R2,000: We believe the stock is fairly valued. We like the strong free cash generation in the business but have a cautious outlook on volume growth as we expect Hero to lose market share to Honda, which in our view will limit re-rating for the stock.

?Kotak Institutional Equities