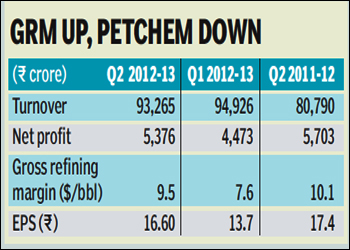

Reliance Industries (RIL), operator of the world?s biggest oil refining complex, reported a 20% sequential jump in profits in the September 2012 quarter, in line with the Street?s expectations. Gross refining margins (GRMs) came in at $9.5 on every barrel of crude it processed into fuel, compared with $7.6 a barrel in the first quarter, driving up the bottom line to R5,376 crore from R4,473 crore in the June quarter. Revenues, however, slipped to R93,265 crore in the three months to September from R94,926 crore in the first quarter of this fiscal.

The company?s stock, which closed at R823.20, up 0.5% from the previous close, has gained nearly 15% in the past three months, outpacing the Sensex, which gained 9% over the same period.

The company?s stock, which closed at R823.20, up 0.5% from the previous close, has gained nearly 15% in the past three months, outpacing the Sensex, which gained 9% over the same period.

While analysts were satisfied with the numbers for the September quarter, they point out that GRMs could drop off in the coming months with refineries in the region resuming production after shutdowns and a slowing demand from China. Analysts are also pencilling in a muted performance from the petrochemicals segment, again on the back of a weak demand, at least for another three to four months.

Controlled by billionaire Mukesh Ambani, India?s wealthiest man, RIL has benefited from its strategy of shifting to cheaper, heavy crude to boost margins. The company’s gains were led by distillates like kerosene and diesel. ?RIL?s business and financial performance for the first half of FY 2012-13 has been satisfactory despite weakness in global economies and the resultant margin environment,? Ambani said in a media release.

The Street remains concerned as output of gas from the KG-D6 basin remains well below projections and the capital employed by the conglomerate remains flat sequentially even though cash reserves are now at R80,000 crore. The RIL stock has underperformed for the better part of the last two years as the management has not clarified how it plans to utilise the cash; although plans for the telecom business have been outlined, analysts don?t see the venture creating wealth in the near term. Moreover, the government has been dragging its feet on clearances for new explorations by the company.

RIL’s year-on-year performance was weak as it continues to grapple with lower demand for petrochemicals and fuels following the European debt crisis and a reduced output at its largest natural gas deposit, KG-D6 basin. The largest Indian company by market value reported its fourth consecutive year on year drop in profit. In the same quarter last year, the company had earned Rs 5,703 crore.

Revenue for RIL’s refining and marketing business fell 1.7% from the first quarter, but earnings before interest and taxes (EBIT) margin swelled to 4.5% from 2.5% in the preceding three month period. RIL’s E&P business and petrochem business did not fare as well in the second quarter.

The company’s oil & gas EBIT fell 10.9% q-o-q and 43.4% y-o-y to Rs 866 crore. Segment revenue fell 10.1% q-o-q and 36.7% y-o-y to Rs 2,254 crore.

During the first half of the fiscal ended September 30, natural gas production from KG-D6 fell 35.1% y-o-y to 197 billion cubic feet, while crude oil production fell 37% y-o-y to 1.7 million barrels.

The petrochemical’s business revenue grew marginally q-o-q and 4.7% y-o-y to Rs 22,058 crore. However, segment EBIT, fell marginally q-o-q and 28.2% y-o-y to Rs1,740 crore.

The company has also been looking to expand its consumer-focused segments such as telecom and retail in recent years in order to meet the target doubling its operating profit in the next four to five years that Ambani outlined at the company annual general shareholder meeting in June.

During the first half of the year, sales at Reliance Retail grew 48% through new store launches and same store sales growth.

RIL, which has seen its cash at hand multiply in the last two years, had cash and cash equivalents of Rs 79,159 crore at the end of the quarter.