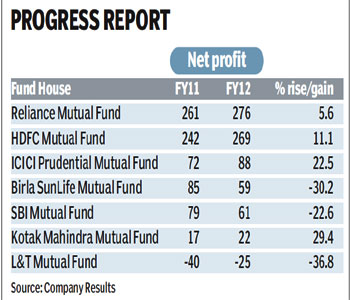

Reliance AMC has emerged as the most profitable fund house in FY12, nudging past rival HDFC Mutual Fund by a few crores, analysis of profit figures for top six fund houses shows. The top three fund houses posted a rise in their net profit figures this fiscal despite the weak equity markets and regulatory changes.

Reliance Mutual Fund posted a net profit of R276 crore for the full year ended March 31, 2012, a 5.6% gain over the previous fiscal. HDFC Mutual Fund?s net profit rose 11% to R269 crore in FY12 from R242 crore in FY11. ICICI Prudential Mutual Fund saw its profit rise 22% to R88 crore from R72 crore for the period under consideration.

Reliance Mutual Fund posted a net profit of R276 crore for the full year ended March 31, 2012, a 5.6% gain over the previous fiscal. HDFC Mutual Fund?s net profit rose 11% to R269 crore in FY12 from R242 crore in FY11. ICICI Prudential Mutual Fund saw its profit rise 22% to R88 crore from R72 crore for the period under consideration.

The top five fund houses make up about 54% of the industry?s assets under management, while the top 10 fund houses make up about 77%.

?We have been investing in technology, widening our reach among retail investors and increasing our branch network over the past few years,? said Sundeep Sikka, CEO, Reliance Mutual Fund. ?We have focused on the right product mix and tried to get retail investors to invest in debt products. Considering that the fund industry still remains under-penetrated, we will keep investing for the future,? Sikka added.

After posting a stellar growth in FY11, Birla Sun Life Mutual Fund saw its net profit erode by 30% to R59 crore in FY12 from R85 crore in FY11. SBI Mutual Fund?s net profit declined 22% to R61 crore in FY12 from R79 crore in the previous fiscal. After a whopping decline in its net profit for FY11 over the previous fiscal, Kotak Mahindra Mutual Fund saw a modest rise in its net profit numbers. ?In the fund management business, profitability is essentially a function of the asset size. We have a wide product bouquet that has enabled us to provide investment opportunities across the entire cross section of investors, including retail and institutional,? said Sandesh Kirkire, CEO, Kotak Asset Management.

The year could prove to be particularly tough for the small fund houses, said market participants. ?It was a tough year and the smaller fund houses are unlikely to make money as they don?t have enough assets and there was no growth,? said Dhirendra Kumar, CEO, Value Research.

In terms of inflows, FY12 was slightly better than FY11 for fund houses. Equity funds saw inflows of R264 crore last year compared with outflows of over R13,000 crore in FY10, according to data compiled by Value Research. However, retail investors stayed away from equities in FY12 as more than 1.5 folios closed in the fiscal. Inflows in gold ETFs amounted to R3,646 crore, a 62% gain over the R2,250 crore collected in FY11. Income and Liquid funds saw combined net outflows of over R25,000 crore in FY12 compared with outflows of over R55,000 crore in FY11.