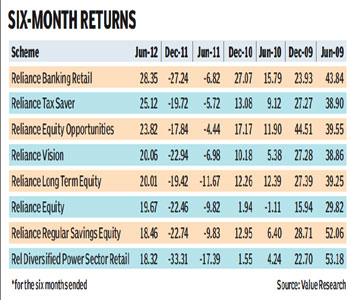

Seven of Reliance Mutual Fund?s schemes have featured among the top 10 performers in a list of 50 equity schemes with assets under management higher than R1,000 crore for the six months to June 2012. The schemes have benefited from the rally in mid- and small-caps and sectors such as banking, auto and industrial, believe experts.

The outperformance of these schemes should come as a relief to the fund house whose overall AUM has shrunk more than 18% to R82,887 crore at the end of June this year compared with R1.02 lakh crore at the end of June 2011.

The outperformance of these schemes should come as a relief to the fund house whose overall AUM has shrunk more than 18% to R82,887 crore at the end of June this year compared with R1.02 lakh crore at the end of June 2011.

The fund house had ceded its number one position in terms of AUM to HDFC MF at the end of December 2011. ?We are committed to creating long-term wealth and short-term market cycles don?t affect us,? said Sundeep Sikka, CEO, Reliance MF.

The Reliance Banking Fund benefited as the banking sector (returns of 29.7%) outperformed the broader markets (12.78%) in 2012. Reliance Vision and Reliance Tax Saver, on the other hand, outperformed their peers in 2012 owing to increased exposure to auto and industrial sectors, which have had a good run in 2012, according to analysts.

Reliance Regular Savings Equity, which mostly invests in small and mid-caps, benefited from having beaten-down names in its portfolio, which rallied when the markets bounced back early this year.

The BSE MidCap (19.9%) and BSE SmallCap (17.7%) beat Sensex returns (12.78%) in the six months to June. Equity funds witnessed outflows in five out of six months this year.

Interestingly, most of these funds faced a tough time in 2011, with several of them underperforming their peers. For instance, Reliance Banking Retail gave negative returns of 27.2% and 6.82% for the six months ended December 2011 and June 2011, respectively. To its credit, though, most of Reliance?s schemes had outperformed the benchmark indices last year. For example, Reliance Equity Opportunities, which invests in mid- and small-caps, gave negative returns of 17.8% and 4.4%, for the six months ended December 2011 and June 2011, respectively. However, BSE Midcap and BSE SmallCap indices had given negative returns of over 25% and 12% for the corresponding periods.

One reason why funds from the Reliance stable suffered was because the fund house took a contrarian stance in 2011 and mostly stayed away from defensive picks, believe analysts. Sunil Singhania, head, equities, RCAM, justifies this strategy by saying the fund house stayed rooted to its philosophy of delivering alpha returns. ?We were focused on creating a differentiated holding last year and stayed away from stocks and sectors where valuations were stressed,? he said.

Despite the volatility in its portfolio over the past year-and-a-half, the fund house continues to remain as aggressive as ever. ?We have a robust investment team of more than 40 people and are now less reliant on views of external brokerage houses,? said Sikka, adding that the firm will continue to hire and expand its geographical reach this year.