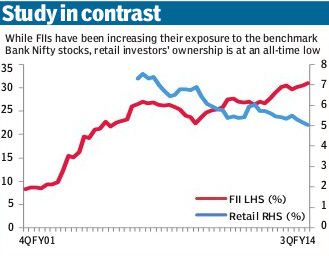

While foreign institutional investors (FIIs) have raised their stake to an all-time high in the benchmark Bank Nifty stocks, retail investors have brought down their exposure to lowest-ever levels.

As on June quarter, retail investors ? individuals with holding up to R1 lakh ? hold 5.05% equity within the Bank Nifty universe. On the other hand, FIIs have continued to accumulate these stocks, taking their exposure to all-time high of 31.12%, shows data collated by Capitaline.

Retail investors have been looking for exit opportunities across the market, said Rikesh Parikh, VP, Motilal Oswal Financial Services. Meanwhile, FII exposure to Bank Nifty has rose as banking sector is always the first to move in the market, he added.

YTD, Bank Nifty has gained 33.88%, outperforming BSE Sensex, which has clocked gains of 21.50% during the same period.

Of the 12 Bank Nifty stocks, retail investors have cut their stake in nine, as per data from Capitaline. Yes Bank has seen the sharpest fall in retail holding in the June quarter, with their holding dropping 2.19 percentage points (ppt) ? from 7.75% in March quarter to 5.56% in June quarter.

Among other scrips, Union Bank (-0.9 ppt), SBI (-0.8 ppt), Canara Bank (-0.62 ppt), PNB (-0.37 ppt), Axis Bank (-0.18 ppt), Indusind Bank (-0.15 ppt), Kotak Mahindra Bank (-0.07 ppt) and ICICI Bank (-0.06 ppt) have all seen retail holding fall in the June quarter.

Meanwhile, FIIs have raised their stake in nine of the 12 Bank Nifty stocks. Incidentally, Bank has seen the sharpest rise in FII holding. The FIIs have raised their stake by 7.33 percentage points in the June quarter; raising their stake from 37.98% in the March quarter to 45.31%.

Among other banking stocks, Kotak Mahindra Bank (3.41 ppt), Canara Bank (2.53 ppt), Union Bank (2.2 ppt), SBI (1.37 ppt), Bank of Baroda (1.33 ppt), Indusind Bank (0.31 ppt), ICICI Bank (0.18 ppt) and PNB (0.17 ppt) have seen a rise in FII holding in June quarter. YTD, FIIs have bought shares worth $12.2 billion.