Even though gold has gradually lost appeal among global investors since 2013 ? amid a compounding consensus view that a decade-long bull run in the yellow metal may be over ? a weaker rupee and restrictive import policies have ensured that, in India, the impact hasn’t been so extreme.

Even as the average global spot price corrected by a third to $1202 an ounce in 2013, domestic spot prices moderated by just about 1% to Rs 29,158 per 10 gm, thanks to a declining average value of the rupee from Rs 53.5 in 2012 to R58.6 against the dollar.

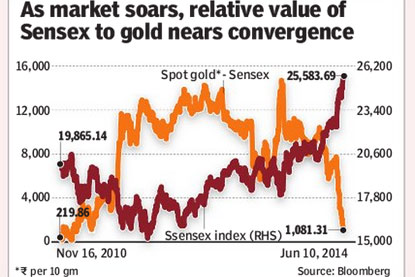

However, the renewed momentum in the Indian equity market, at a time when the domestic gold prices are in a corrective mode, is likely to impact the investment interest in the yellow metal. In 2014 so far, while the Sensex has gained as much as 21%, the domestic spot gold price, which currently stands near Rs 26,665, has lost 8%. As a result, the relative value of Sensex to the benchmark gold rate has come closer to convergence, for the first time since November 2011.

Market experts see equities regaining some of the investor interest they had lost to the precious metal as an investment avenue after the global financial crisis.

As per Anil Rego, CEO of Right Horizons Wealth Management, given that investment flow towards any asset class is primarily driven by future outlook, investors are likely to prefer equities to gold.

?A rising risk appetite among investors would also weigh on allocation towards gold, which is considered a hedge against uncertainties and is favoured during a risk averse investment sentiment,? added Rego.

Experts also argue that even as the allocation towards gold from hedging perspective may continue, from capital gains or returns perspective, the investor orientation is likely to come off.

?The tendency to hoard gold as an investment has definitely come down in the last one year, especially among high networth individuals who take informed investment decisions and adjust their portfolio exposures actively,? said the head of private wealth operations at a domestic broking firm.

Following more than $45 billion of foreign institutional flows between 2012 and 2013 that pushed the Indian benchmark indices to a two-year highs, domestic investors have largely opted out, given the sustained outflow from equity mutual funds and continuous selling by the domestic institutions, of the order of $24 billion, during the period.

The scenario is likely to improve this year, believe some experts, as retail investors may get convinced of the scope of surge in equities with the revival in the Indian economy. A lower base of domestic gold prices could further enhance a shift towards equities.

?Gold prices risk a 15-18% downside from current levels towards Rs 22,000-22,500 levels,? added Rego.

Domestic gold prices have given positive returns each year since 2000 even as the annual returns on Sensex turned negative in both 2008 and 2011.