Greenko Dutch BV is eyeing to tap the overseas bond market to raise funds for refinancing purposes. Moody’s Investors Service has assigned a provisional ‘(P)Ba2’ rating to the proposed 7-year dollar-backed senior unsecured notes. “The proposed $950 million notes are guaranteed by GDBV’s holding company, Greenko Energy Holdings (GEH),” Moody’s said in a release. GDBV is a special purpose vehicle which will use the proceeds from the notes to subscribe to senior secured rupee non-convertible debentures (NCDs) to be issued by each of the other restricted subsidiaries in the restricted group (RG3), which are wholly-owned/majority-owned by GEH, Moody’s said in the release. “The proceeds from the NCDs will be used to refinance the existing debt of the restricted subsidiaries, including the existing $550 million notes due 2019, project finance debt and shareholder loans associated with the operating projects that the parent transfers to RG3,” the release said.

Fitch Ratings has assigned Greenko Dutch BV’s proposed US dollar senior guaranteed notes an expected rating of ‘BB-(EXP)’. Greenko is guaranteeing the proposed notes, which do not enhance their assigned expected rating as the credit risk profile of Greenko is assessed as weaker than that of GBV, Fitch pointed out in its release.

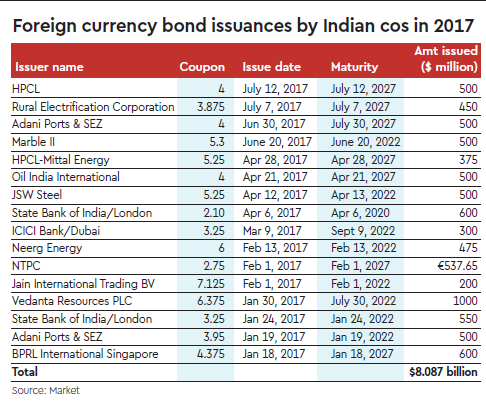

Bloomberg data shows that Greenko Dutch BV had issued bonds worth $550 million in 2014 at 8%. Indian issuers have raised a record amount of more than $8 billion via overseas bond issuances this year. This is more than the total issuances done in the last two calendar years according to investment bankers.

Top-rated Indian issuers are finding tight pricings in overseas debt market in recent times. HPCL recently concluded the pricing of its dollar bonds at 167.50 basis points over the 10-year US Treasury yield. Prior to that, Rural Electrification Corp had priced its dollar bonds at 167.50 basis points over the benchmark US Treasury yield.