Good quarter but challenges lie ahead: Hindustan Unilever’s Q2FY14 earnings print was marginally ahead of our expectations due to higher-than-expected (i) revenue growth in the personal products segment and (ii) gross margin expansion, driven by the S&D (soaps & detergents) segment. The credible performance notwithstanding, the challenge would be to sustain this performance given margin pressures ahead and scant evidence of a demand recovery. We are sellers due to the marginal Q2 beat.

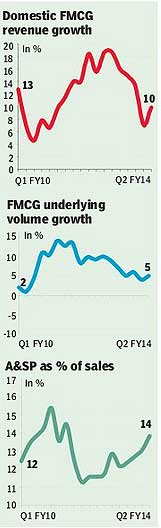

Q2FY14 financials: Reported net operating income was R68.9 bn (+9% y-o-y), 1% ahead of our expectations. FMCG sales (revenues less other operating income) were R67.5 bn (+10% year-on-year), again 1% ahead of our expectations. Underlying volume growth (UVG) was 5%, broadly in the same vicinity as the past two quarters. S&D revenue growth decelerated to 6% y-o-y while personal products growth accelerated to 12% y-o-y, from 2% in Q1; we had expected acceleration of 8%.

Below-Ebitda items drive PAT outperformance: Reported Ebitda was R10.85 bn (+11% y-o-y), 2% ahead of our expectations, driven by modest revenue as well as OPM (operating profit margin) beat. Ebitda margin for the quarter was 15.7%, +26 bps y-o-y. Adjusted recurring net income for the quarter was R8.8 bn. Reported net income for the quarter was R9.14 bn .

Good quarter but challenges persist: HUL delivered recurring net income of R17.9 bn in H1FY14, a modest growth of 7.4% y-o-y. Recurring EPS for H1 was R8.3. H2 faces additional gross margin pressure and HUL may report a lower y-o-y EPS growth in H2 compared with H1. Even as absolute downside may be capped due to corporate action expectations and a recent run-up in valuations of some peers, we find it difficult to turn constructive on fundamentals. Our cautious stance stays.

Segmental performance highlights

* Soaps and detergents (49% of revenue, 44% of Ebit). Revenue growth moderated as expected but margins surprised. S&D revenue growth slowed to just about 6% y-o-y largely due to price deflation in soaps (price-offs/promotions) and detergents (high competitive intensity; HUL is running several price-offs/promotions on all its detergent brands). However, segment OPM (operating profit margin) surprised, rising 110 bps q-o-q and down 30 bps y-o-y (on a high base) to 14%, perhaps aided by a benign RM (raw material) environment; we are not sure whether Q2 S&D margins saw the impact of the rupee depreciation and/or increase in LAB (linear alkyl benzene) prices. HUL indicated:

(i) strong double-digit volume growth for popular-segment

soap brands?Lux, Breeze and Lifebuoy; the premium end struggled for growth, (ii) stabilising signs of growth for Wheel; our channel checks suggest that things have not improved materially for Wheel; (iii) strong growth for Surf and Rin?volume growth, in our view; not value growth, given a sharp step-up in promotional activity; and (iv) double-digit growth in Vim and Domex?creditable performance against the backdrop of a new entrant in the dish-wash category (Dettol).

* Personal products (28% of revenues, 41% of Ebit). Revenue recovered but margins shrank to new lows. Revenue growth was about 12% y-o-y (marginally ahead of expectations) but absolute Ebit (earnings before interest & taxes) growth was just 5% as segment margins contracted 140 bps y-o-y/205 bps q-o-q to new recent lows of 22.8% (near Q1FY10 levels). We attribute weak margins to (i) a step-up in A&SP (advertising and sales promotions) spends to defend market share in the oral-care category and the relaunch of FAL (Fair and Lovely) towards the end of the quarter and (ii) lower contribution of higher margin FAL (facing stagnancy due to weak category growth). The company indicated (i) a step-up in skin care growth to double-digits?partially aided by strong primary sales of the winter skin-care portfolio, (ii) sustained strong growth for Lakme and Dove, (iii) double-digit volume growth in the hair-care segment, and (iv) double-digit revenue growth for Close-up and Pepsodent.

* Beverages (12% of revenue, 13% of Ebit): Another solid quarter. Revenue grew 16%, with a solid 260 bps margin expansion and 37.5% y-o-y Ebit growth. Segment performance was a reflection of benign input costs and rational competition. HUL indicated its tea business posted one of its strongest quarters. Green tea bags did well, posting a near doubling of sales this quarter.

* Foods (6% of revenues, 1% of Ebit). Growth picked up marginally to 9% y-o-y, led by double-digit growth in Kissan ketchups though margins were volatile in the segment (3% Ebit margin). HUL indicated growth in ice-creams picked up to double-digits.

Kotak Institutional Equities