Finance minister Arun Jaitley would do well to settle larger chunks of relatively smaller tax disputes within the revenue department instead of letting them reach tribunals and courts, leading to an accumulation of tax disputes.

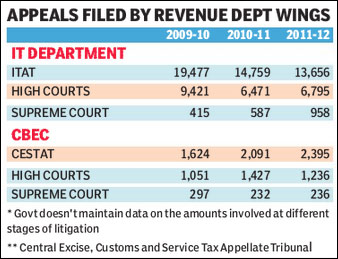

Another way, experts said, to reduce time-consuming litigation that impacts businesses is to make the department appeal against judicial orders much more infrequently than now.

The present thresholds of disputed tax amount, above which assessment officers concerned can appeal against the decisions taken by the Commissioner (Appeals), are Rs three lakh without interest and penalty in the case of direct taxes and Rs five lakh with or without interest and penalty in the case of indirect taxes.

Raising these thresholds two or three-fold would prevent a large number of disputes from reaching tribunals and from there courts, experts said, adding that there could also be similar increases in the monetary limits set for the department to challenge the orders of tribunals at courts.

The current monetary limits (for appeals) were decided in 2011, when the government revised the limits set in 2008 for direct taxes and in 2010 for indirect taxes. For both direct and indirect taxes, the current monetary limits for filing appeals at High Courts and Supreme Courts are Rs 10 lakh and Rs 25 lakh, respectively. When constitutional question is there, no monetary threshold is applicable.

?If the current monetary limits are raised by two to three times, it would give relief to small tax payers and help in substantially reducing litigation,? said SP Singh, senior director, Deloitte, Haskins & Sells.

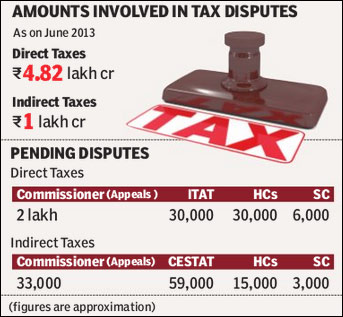

As per official estimates released last June, tax disputes of more than Rs 4.82 lakh crore of direct taxes and over Rs one lakh crore of indirect taxes were at various stages. Direct tax disputes cover transfer pricing too, on which India has the largest number of disputes by volume.

Another way to cut down avoidable dispute is to effectively use the feedback from High Courts. ?If on one issue, there are multiple decisions by the tribunal favouring the taxpayer and High Courts refuse to admit an appeal, then it would be prudent to issue an internal circular to direct officers not to make (income) additions on the same issue in the case of other tax payers,? said SP Singh.

This would greatly reduce disputes at the tribunal stage and will have a positive cascading effect on the number of disputes at higher levels, thus increasing the efficiency of the administrative machinery.

Besides revising the monetary limits for appeals, the department could also take a few easy to implement administrative steps to curtail mounting tax disputes, experts said.

According to Girish Vanvari, co-head of tax, KPMG in India, it can very easily take 12 to 20 years to resolve a dispute that goes up to the Supreme Court, provided there is no further amendment to the law. And till the disputed issue is settled finally, it crops up in every year?s assessment, leading to a multiplier effect. The tax payer is thus forced to pay the disputed amount in part or in full till its final resolution and the amount gets locked up with the department for a long time.

?Thus, there is need for fast tracking the process for litigation (especially the bigger ones) and also specific instructions are required to provide clarity on collecting and releasing disputed demand,? said Vanvari. Another concern that many businesses share is that tax officers tend to err in favour of the government while taking decisions as their responsibility also includes meeting revenue targets. They say that tax officials should be fair while deciding on appeals rather than merely endorsing the orders of their junior officers.

?Setting unrealistic revenue collection targets in an economy that is not doing well will lead to unnecessary litigation. A strong message for attitudinal change needs to be conveyed from the top of the executive to the field force,? said Harishanker Subramaniam, tax partner and national leader – indirect tax services, Ernst & Young.

According to Rahul Garg, leader, direct tax, PWC India, many dispute arise because of varied application of law and of lack of understanding of peculiar businesses. He said tax assessment (including self assessment) should be guided by reliable and binding position of the revenue and standard audit investigation plans.

Taxpayers also say officers? performance should not be assessed by the quantum of income adjustments but by the quality of adjustments.