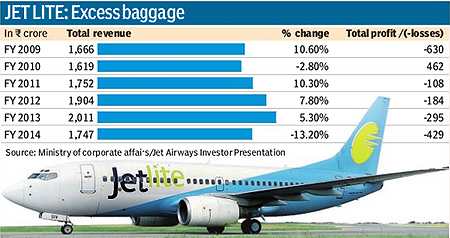

Seven years after it took off, budget carrier JetKonnect is still struggling to find its feet. The no frills airline?s losses widened to Rs 429 crore in FY14 from Rs 295 crore in the previous year, according to data submitted by Jet Lite to the ministry of corporate affairs (MCA). In May, JetKonnect?s market share slipped to just 3.9% from 5.4% at the end of March.

Indeed, JetKonnect, run by JetLite (India), the fully-owned subsidiary of Jet Airways, has posted an annual profit only once in the last six financial years, while its losses have quadrupled in the last four years. The revenues of the airline, which is run by the same management team that operates Jet Airways, fell 13.2% year-on-year to Rs 1,747 crore FY14. During the same period, the airline?s parent company, Jet Airways, saw its consolidated losses widen to Rs 4,129.76 crore from R779.78 crore in fiscal 2013.

Industry experts say JetLite?s troubles stem from the fact that Jet Airways doesn?t have a clear strategy and a viable business in place for the low-cost carrier as it grapples with a high cost structure. ?JetLite has been neglected by Jet Airways,? Kapil Kaul, chief executive of CAPA-Centre for Aviation, South Asia observes. Kaul believes one of the reasons for the widening losses is the cost structure of the airline, which is the highest among competitors.

Jetlite?s cost of available seat-kilometre (CASK), a measure of unit cost, was 25% higher than that of SpiceJet, the only listed no-frills carrier, in FY14. While JetLite?s CASK stood at R5, SpiceJet?s CASK stood at R4.04, CAPA data shows. Furthermore, JetLite?s revenues have been affected due to a fleet rationalisation exercise undertaken by the company that resulted in lesser capacity to ferry passengers, said Kaul. JetLite?s current fleet size at the FY14 stood at 12 Boeing 737 aircraft, down from 15 in FY13, and 19 in FY12, according to CAPA data.

?Some of JetLite?s costs like salaries are higher than those of its competitors like IndiGo and SpiceJet,? said an aviation sector analyst with a foreign brokerage. Analysts note that while JetLite clearly needs to notch up more market share to break even, that seems to be getting increasingly difficult with the entry of AirAsia India who are offering rock bottom fares on some routes. Moreover, incumbents like IndiGo are joining the price war even as they spruce up their fleet, they point out.

Phone calls and messages sent to Jet Airways executives seeking comments for this story did not elicit any response.

Though JetLite continues to post losses and has a ?negative net worth,? according to a stock market filing by Jet Airways, the Naresh Goyal-led airline hasn?t given up on the potential of a turnaround at its subsidiary that it acquired from the Sahara Group in April 2007. Jet Airways, which has an equity investment of R1,645 crore in JetLite, is also pumping additional money into its subsidiary. It advanced an interest-free loan of R1,954 crore to its JetLite in fiscal 2014, according to a BSE filing by the company.

Jet Airways roped in US-based consultant Seabury Group in July-August 2013 to reorganize its fleet and network, in an attempt to better align it between JetLite and itself. This led to Jet Airways taking a one-time impairment charge of Rs700 crore in fiscal 2014.

?Seabury Group has valued the equity interest in JetLite and a detailed business plans has been drawn to get the airline back to profitability,? a statement issued by Jet Airways in May read. ?Management has performed a sensitive analysis on values so arrived and concluded that provision for iminution/impairment of Rs700 crore will fairly reflect the recoverable amount based on prudent assessment,? it added. On the back of such fleet and network reorganization, Jet Airways expects its operations, including that of JetLite, to return to profitability by FY17.

N. Ravichandran, vice president of finance at Jet Airways said during the company?s fourth quarter earnings call his company has chalked out a roadmap for network and fleet integration with Etihad Airways ? which had picked up a 24% stake in Jet Airways for Rs 2,060 crore in the Indian airline last fiscal—, and other partner airlines.

CAPA?s Kaul says that JetLite?s turnaround plan will largely depend on its fleet strategy. According to him, JetLite could either expand its capacity by adding different types of aircraft to its fleet and feed greater number of passengers to its parent company?s operations, especially international flights; or it could stick to its one aircraft fleet (comprising Boeing 737s) to optimise costs. ?My sense is that that they will keep it to a one aircraft fleet,? said Kaul. JetLite could also reinvent itself away from being a pure no-frill carrier by adding limited business class and premium economy seats to its fleet, he added.

Around 77% of Jet Airways? losses in fiscal 2014 are on account of its domestic business, says Kaul. JetLite forms a significant portion of this business. The low-cost carrier?s revenues accounted for 9.18% of Jet Airways? consolidated total income from operations (revenues) in the last financial year, according to MCA data. Indian airlines have long been burdened due to operating costs, which is one of the highest in the world. They have to paymore for jet fuel and by way of hefty taxes. In a price conscious market, revenues aren?t adequate to always cover costs.