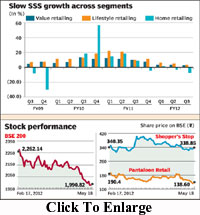

Disappointment in Pantaloon Retail?s (PRIL) core retail business continued in Q3FY12 as well with core PAT (profit after tax) coming in well below our estimate (though sales in line and Ebitda above estimate) primarily on account of a sharp surge in interest cost. SSS (same-store sales) growth deteriorated across formats?only 2.66% in value retail (3.18% in Q2FY12), 3.46% in lifestyle (5.27% in Q2FY12) and 7.33% decline in home retail (3.18% decline in Q2FY12)?despite the quarter being marked by extended discount sales period. For the same period, Shoppers Stop posted 10% year-on-year SSS growth for departmental stores and 6% for HyperCity.

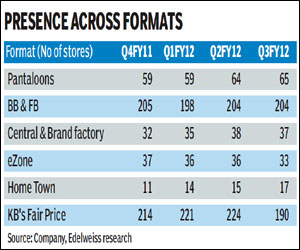

New space expansion was 0.51m sq ft in Q3FY12; however, accounting for closures (primarily Ezone and KB Fair), space addition was mere 0.03m sq ft. But, we fail to understand the logic behind expansion in Home Town (added six in past three quarters) at a time home sales are languishing. The only positive was slight (36bps) expansion in Ebitda (earnings before interest, taxes, depreciation and amortisation) margin. Key triggers for the stock will be likely sale of non-core assets and tie ups. Maintain ?Hold?.

New space expansion was 0.51m sq ft in Q3FY12; however, accounting for closures (primarily Ezone and KB Fair), space addition was mere 0.03m sq ft. But, we fail to understand the logic behind expansion in Home Town (added six in past three quarters) at a time home sales are languishing. The only positive was slight (36bps) expansion in Ebitda (earnings before interest, taxes, depreciation and amortisation) margin. Key triggers for the stock will be likely sale of non-core assets and tie ups. Maintain ?Hold?.

Higher interest expense gobble down profit: PRIL?s net sales increased 7.6% y-o-y to R30.3bn in Q3FY12 (March quarter). The SSS were impacted by weak demand in home and electronics. Apparels have not picked up as much as expected. PAT declined a whopping 76.2% y-o-y to R120m following higher interest expense (up 57.5% y-o-y). This is expected to dip by R400m-500m per quarter from FY13e due to cash infusion on the back of recent deals.

Ebitda margin improves on back of prudent cost management: Ebitda margin improved 36bps y-o-y to 9.2% despite 56 bps (basis points) y-o-y expansion in rent (7.2% of sales) due to prudent cost management?raw material cost, staff costs and other costs down 28bps, 16bps and 47bps y-o-y, respectively.

Other key highlights

Offloads controlling stake in retail format stores to Aditya Birla Nuvo: To reduce debt, PRIL will offload a majority stake in its retail format to Aditya Birla Nuvo (ABNL). Retail and factory outlet formats will be demerged from PRIL. The transaction: PRIL will issue debentures to ABNL worth R8,000m at mutually agreed terms, convertible in equity shares of the resulting entity i.e., PRIL?s format business. PRIL will demerge its Pantaloons Format business through a court scheme of arrangement. The company will transfer the net assets of its business, its apportioned debt of R8,000m and debentures of R8,000m to the resulting entity.

This deal is valued at 13x EV(enterprise value)/Ebitda i.e., EV comes to around R26,000m. With debt of R8,000m, valuation comes to around R18,000m.

On completion of demerger, the debentures will convert into equity of demerged entity of Pantaloon Format. This will ensure 44% stake of ABNL in the demerged entity. ABNL plans to hike its stake to 50.01% via an open offer. Thereby, the resulting entity will become a subsidiary of ABNL. Existing PRIL shareholders will continue to own shares in the demerged entity. Thus, the promoter post-demerger will hold about 25% stake in the carved out entity.

Post-demerger, PRIL?s total debt will reduce by R16,000m (R8,000mn debt will be moved to demerged entity?s books and R8,000m consideration paid by ABNL will be used to reduce the debt).

R2,000m raised from Bennett Coleman: With a focus on paring debt, PRIL raised R2,000m by issuing 8.16m shares to Bennett Coleman & Co (BCCL) at R245 on a preferential basis. After this transaction, BCCL?s stake in the company will rise from 2.12% to 5.8% while promoter holdings will dip 1.6% to 43.0%. The allotment will be completed post-EGM (emergency general meeting) on May 30, 2012, and receipt of full subscription amount in cash from BCCL.

Future Capital Holdings to be sold: PRIL is set to sell its entire 53.67% stake in its subsidiary, Future Capital Holdings (FCH), through a block deal on the stock exchange to its wholly owned subsidiary Future Value Retail (FVRL). This is in line with the company?s strategy to sell its non-core businesses.

Restructuring Big Bazaar to cut costs: Future Group is restructuring its Big Bazaar stores to cut costs and stay profitable. The company has already shut a few stores and refurbished around 20 stores, giving them a younger look. The company has also launched new logo and the tagline has been changed to ?Naye India Ka Bazaar? from ?Isse Sasta Aur Achcha Kahin Nahin?. Some Big Bazaar stores have also been re-sized to improve store productivity and efficiency and more fresh food has been introduced to increase the share of food to the total revenue. These developments will improve the employee cost on per-square feet basis.

Concept store launched in Vizag: PRIL launched its first concept store in Vizag spread over five levels with an area of 27,703 sq ft, designed to create an international shopping experience for customers. The management believes Vizag is one of the fastest growing cities, fashion consciousness being high on the minds of consumers. We believe this will aid the company expand its stronghold in tier-II cities by trying out such new concepts.

Looking to expand in gourmet food retail: The Future Group is aiming to open 7-8 new ?Food Hall? stores in the country citing the huge growth potential in the gourmet food retail category. Food Hall sells premium fresh and packaged foods of domestic and international brands, ready-to-eat items, cuisines from across continents and health foods. The format also has an open kitchen serving fresh cooked food and a live bakery.

Partnering Disney to launch cookies: Future Group has partnered Disney to launch cookies for kids under the brand Tasty Treat. The company believes the cookie segment is growing 3x (times) the overall biscuits market and the kids? segment is untapped. It will launch a range of ?Kidz Cookies? with popular Disney characters and the product is being developed with Unibic.

We like PRIL?s diversified mix of retail business and size, but burgeoning debt, rapid expansion and higher inventory days remain key concerns. At CMP (current market price), the stock is trading at 35.7x FY12e and 26.6x FY13e EPS (earnings per share).

Edelweiss