The number of companies that opted to split their shares declined nearly 35% during the first nine months of the current calendar year.

Analysts attribute this trend to the already beaten-down value, amid the European crisis and the domestic uncertainty over policy action, that has set a negative tone for the companies to opt for the share-split route.

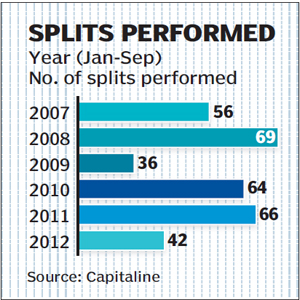

According to Capitaline data, the number of companies going for stock split stood at 43 during the first nine months against 66 during the same period last year. Barring 2009, when 36 companies opted for stock split, the current year has seen the lowest number since 2007. In 2011 (full year), as many as 85 companies carried out stock-split activities.

Analysts said one of the reasons behind performing stock split is to make the stock appear cheaper by diving the outstanding shares, thereby luring small or retail investors into buying a significant number of shares. However, markets were already in a depressed state and liquidity was tight during the first 6-8 months, and making the stock look cheaper in such an environment may not have been a logical approach.

Analysts said one of the reasons behind performing stock split is to make the stock appear cheaper by diving the outstanding shares, thereby luring small or retail investors into buying a significant number of shares. However, markets were already in a depressed state and liquidity was tight during the first 6-8 months, and making the stock look cheaper in such an environment may not have been a logical approach.

During most part of 2012, Indian equities were trading around 12 times price multiples (E) versus the historical average of 14-15 times on a one-year forward basis. On price-to-book value, Indian equities were trading at more than 20% discount to historical averages.

?Share split is adopted to change the psyche of retail investors and to pump up volume and liquidity. However, valuations and market cap remain the same. Nothing else changes,? said K Sandeep Nayak, ED&CEO, Centrum Broking.

Stock split is a tool through which companies can divide their existing shares into multiple shares when a company’s share price has phenomenally increased, so that many investors find the stock too expensive to buy in round lots. While the number of outstanding shares increases by a split ratio, the market capitalisation and valuations remain unchanged prior to split.

Interestingly, analysts said many of those 42 companies that performed stock split this year did not have the real need to do so, but went ahead with a perspective to attract small investors.

?Despite the necessity, many stocks quoting in one-digit, two-digits and lower three-digits (below R400-500) went for share split to influence the stock price and attract retail investors. Many of such retail investors do not have access to subscribed database and are often misguided as they fail to get the right information or the adjusted price after such announcements,? said market expert Ambareesh Baliga.

Analysts were of the view that share split is a tool, which should be logically used and market regulators should define a specific price point, below which companies should not be allowed to perform share split. ?Barriers should be set up to avoid price manipulation and trapping of retail investors,? said an analyst with Edelweiss Financial Services.

According to Capitaline data, shares of more than 30 companies were trading in one-digit, two-digits, and lower three digits at the time when share splits were performed. Only seven companies had their shares quoting in higher three digits or four digits.