Growth, profitability to fall sharply

Deferred inflows amid weak local capex sentiment and bureaucratic inaction afford a base case inflow growth of 8.5% against management guidance of 15-20% growth. At 15x 1-year forward EPS, L&T is trading 25% below historical average.

However, we would be wary of valuations using historical multiples, as we expect growth trajectory and profitability to fall sharply over the next two-three years. We assume coverage, and downgrade to UW (underweight) with September 2013 SOP (sum-of-the-parts)-based PT of R1,150 implying a 15% potential downside. L&T has outperformed the Sensex by 20% YTD (year-to-date), despite the government?s failure to keep its promise of delivering on policy reform.

However, we would be wary of valuations using historical multiples, as we expect growth trajectory and profitability to fall sharply over the next two-three years. We assume coverage, and downgrade to UW (underweight) with September 2013 SOP (sum-of-the-parts)-based PT of R1,150 implying a 15% potential downside. L&T has outperformed the Sensex by 20% YTD (year-to-date), despite the government?s failure to keep its promise of delivering on policy reform.

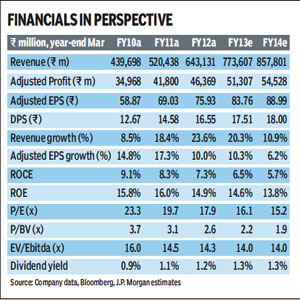

Reading into past & future trends: In the last three fiscals, L&T has underperformed the Sensex in Q3. The ask-on inflows or revenue in H2 of these fiscals mounted, and guidance was pruned twice. Actual year-end performance was much lower. L&T is headed for a similar predicament in the current fiscal. A declining book/bill post-11% inflow de-growth in FY12 and 8.5% established growth in FY13 affords 10% top-line growth in FY14e, half of the current fiscal. FY12-14e EPS CAGR (compound annual growth rate in earnings per share) is just 6.1% vs 17% over FY10-12. Estimated standalone RoE reduces 220bps to 15.2% from FY12-14.

Consolidated RoCE headed down further: Over the last two years, L&T?s captive developmental project portfolio has grown 3x to R850 bn against consolidated net-fixed assets of R343 bn at the end of FY12. For instance, five of the seven road projects which L&T has commissioned over last three years have still not started making profits. Consolidated RoCE (return on capital employed) is down from 9.1% in FY10 to 7.3% in FY12, we estimate a fall to 5.7% by FY14.

Our PT factors in a 15% conglomerate discount, as L&T?s investment mix shifts towards projects with utility characteristics. Strong policy action to kick-start the capex cycle, positive surprise on overseas inflows, and significant value unlocking in developmental portfolio are upside risks.

Price target and valuation analysis: Our new SOP-based September 2013 PT of R1,150 includes R950 for the parent company and R406 for subsidiaries and associates. Risks to our PT (i) Policy action to boost business confidence and revive the investment cycle to support higher GDP growth levels and hence increased domestic orders for L&T.

JP Morgan