Modest recovery in demand on nascent industrial sector revival

The Indian capital goods sector has outperformed the Sensex by 16% year-to-date (YTD). This is led by Larsen & Toubro, which has outperformed the Sensex by 42% YTD, Thermax by 22% and ABB India by 14%. BHEL has underperformed by 17%. However, the industrial and infrastructure sector P/E (price-to-earnings ratio) is still 15x?much lower than the historical levels of 25-35x seen in the cyclical upturn. Also, currently the sector does not enjoy any premium over the Sensex multiple.

Industrial and infrastructure stocks have historically led the economic cycles and their earnings in relation to order-book growth tend to react much later with a lag of two to three years due to their order backlog. Hence, for most players the order slowdown seen during FY11 and FY12 is already factored in in FY13 earnings de-growth and the stocks have already seen a de-rating. However, the data does seem to suggest that there is a nascent recovery in the industrial sector.

Industrial and infrastructure stocks have historically led the economic cycles and their earnings in relation to order-book growth tend to react much later with a lag of two to three years due to their order backlog. Hence, for most players the order slowdown seen during FY11 and FY12 is already factored in in FY13 earnings de-growth and the stocks have already seen a de-rating. However, the data does seem to suggest that there is a nascent recovery in the industrial sector.

Our estimates factor in a modest recovery in demand, largely driven by railroad and energy capex. We still do not build in any triggers for demand recovery in the power sector. The improvement in free cash flow (FCF) is coming from a lower NWC (net working capital)-to-sales ratio.

Our estimates factor in a modest recovery in demand, largely driven by railroad and energy capex. We still do not build in any triggers for demand recovery in the power sector. The improvement in free cash flow (FCF) is coming from a lower NWC (net working capital)-to-sales ratio.

We recommend selective buying in Indian industrial names that have support for value locking. L&T remains our top pick. We continue to value L&T on an sum-of-the-parts valuation basis with a 12-month target of R1,805.

Value unlocking is the key to re-rating in the stock

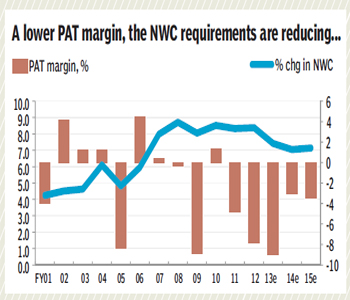

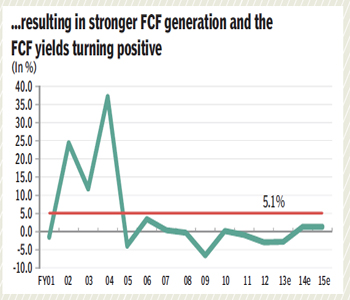

L&T?s FCF generation over the next two years in the core engineering & construction (E&C) business is likely to turn positive for the following reasons. Firstly, it has come to the end of its capacity addition programme, which is likely to lead annual capex costs to fall to levels similar to depreciation (or even probably lower). Our assumptions for L&T factor in investments in IDPL of R15 billion per year for the next three years versus guidance of negligible incremental investments in IDPL by the company. Secondly, the company?s NWC-to-sales ratio deteriorated over the past three years, largely to support its subsidiaries and vendors. With management increasing focus on this front and the improving liquidity, the change in NWC-to-sales is likely to be much lower than the PAT margin?implying improvement in operating cash flows.

L&T?s FCF generation over the next two years in the core engineering & construction (E&C) business is likely to turn positive for the following reasons. Firstly, it has come to the end of its capacity addition programme, which is likely to lead annual capex costs to fall to levels similar to depreciation (or even probably lower). Our assumptions for L&T factor in investments in IDPL of R15 billion per year for the next three years versus guidance of negligible incremental investments in IDPL by the company. Secondly, the company?s NWC-to-sales ratio deteriorated over the past three years, largely to support its subsidiaries and vendors. With management increasing focus on this front and the improving liquidity, the change in NWC-to-sales is likely to be much lower than the PAT margin?implying improvement in operating cash flows.

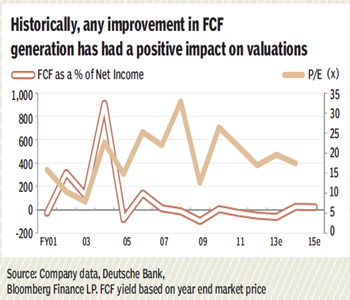

Led by the above changes, we expect the standalone financials to generate an FCF of R12.5 billion in FY14 (implying FCF yields of 1.3%, at the current stock price?a 400 bps improvement y-o-y). From a stock perspective, we have historically seen that improvement in FCF of the parent company has a fairly direct impact on the valuations of the stock.

Deutsche Bank