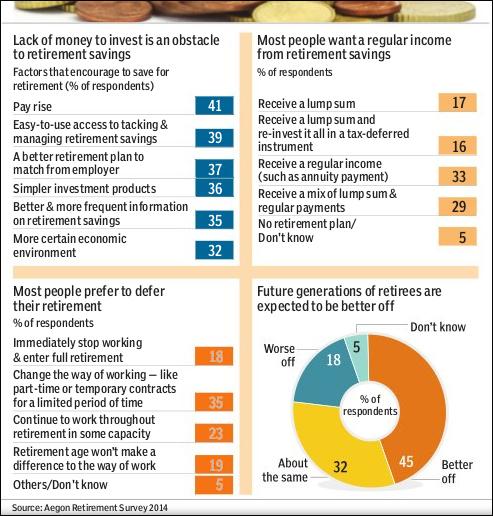

Simple investment products offering guaranteed payouts will ensure that people channelise their money into pension products. While the future generations of retirees are expected to be better off, a flexible transition to retirement will become the new norm as a majority of Indians plan to change the way they work ? whether temporary or part-time ? once they retire. A survey by Aegon found that

a lack of money to invest is a major impediment to saving for retirement, and a pay rise encourages most towards this goal. Though people use a range of financial instruments, such as FDs, life insurance, PF, gold and real estate, most respondents said they would prefer low-return, guaranteed pension over one that offered higher returns but was more uncertain.