Indian equities gave up their gains in the early part of the session to end in the red on Thursday as higher-than-expected inflation tempered expectations of a big rate cut from the central bank on Monday.

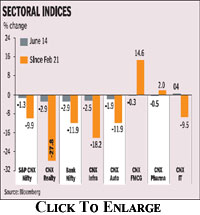

The Street which had been factoring in a 50-basis-point cut in the key repo rate lowered its hopes as headline inflation came in at 7.55% and core inflation printed at 4.86%, above estimates.The Sensex lost 202.63 points, or 1.20%, to close at 16,677.88, while the broader Nifty ended the session down 66.70 points, or 1.30%, at 5,054.75. Interest rate sensitives were battered with both the Bank Nifty and CNX Realty giving up 2.9% and CNX Infra and auto indices losing more than 2%. The fall in Indian equity markets was higher than that in the markets of Asian peers with the Hang Seng, Shanghai Composite, Taiex and FTSE Straits Times ending marginally down, and Korea KOSPI closing with nearly 1% gains.

The Street which had been factoring in a 50-basis-point cut in the key repo rate lowered its hopes as headline inflation came in at 7.55% and core inflation printed at 4.86%, above estimates.The Sensex lost 202.63 points, or 1.20%, to close at 16,677.88, while the broader Nifty ended the session down 66.70 points, or 1.30%, at 5,054.75. Interest rate sensitives were battered with both the Bank Nifty and CNX Realty giving up 2.9% and CNX Infra and auto indices losing more than 2%. The fall in Indian equity markets was higher than that in the markets of Asian peers with the Hang Seng, Shanghai Composite, Taiex and FTSE Straits Times ending marginally down, and Korea KOSPI closing with nearly 1% gains.

The sharp drop in stock prices on Thursday was also the result of heightened political uncertainty in the wake of the presidential election. ?The political tension from the nomination of presidential candidates and the deferral of an expected 10% price hike in urea highlighted the policy inertia that continues to affect the investment sentiment,? said Gopal Agarwal of Mirae Asset.

?After a 50-bps cut in April, the RBI?s guidance was also towards limited room for further change. We believe this guidance may not necessarily change as inflation risks stay strong,? said Indranil Pan, chief economist, Kotak Mahindra Bank.

According to a note by Nomura, the momentum in core inflation suggests that manufacturers have not benefited from lower global commodity prices due to rupee depreciation. ?We expect the RBI to cut the repo rate by 25bps at its policy meeting on 18 June and by a total of 50bps in 2012 ,? it said According to Agarwal, slowing industrial production numbers, moderating core inflation and an average 12% decline in the global crude oil prices since the start of the month may not dent the expected policy action from RBI. This view is echoed by Barclays Capital, which believes the growth slowdown has sprung a large downside surprise. ?Not only was the GDP data for January-March dismal, indications are there for continued weakness in the current quarter as well, as indicated by the April industrial production (IP) print. On the other hand, there has not been a major surprise on the inflation front.? The core inflation, which the RBI emphasises on much more these days, remained contained under the 5% mark for the third straight month. Barclays believes the pressure on RBI to help revive growth remains significant, which may lead to a 25 bps reduction in repo rate on Monday.

European equities, too, were in the red after Moody?s Investors Service downgraded Spain?s rating by three steps to Baa3 from A3 late Wednesday, citing the nation?s increased debt burden, weakening economy and limited access to capital markets. At 1752 IST, FTSE was trading down 0.9%, CAC was down 0.8% and DAX was down 1%. According to a dealer, Thursday’s market fall, while the FII remained net buyers of R105 crore of Indian equities, is an indication that traders are lightening up their equity exposure ahead of the event risks of Greece re-election scheduled on June 17 and RBI monetary policy decision on Monday.