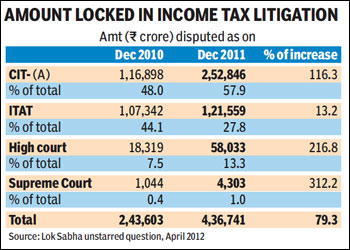

A decline in revenue productivity since 2007-08 has made the tax authorities aggressively step up the pace of mobilisation, sparking a dramatic increase in the amount locked up in litigation at tribunals and courts. According to finance ministry data, the disputed direct tax claims skyrocketed to R4.37 lakh crore by end-2011 from R2.44 lakh crore a year ago.

For taxpayers, especially corporates, the taxman’s intrusive approach could not have come at a worse time, given the pressure on business volumes and margins in a slowing economy.

For taxpayers, especially corporates, the taxman’s intrusive approach could not have come at a worse time, given the pressure on business volumes and margins in a slowing economy.

The unprecedented level ? R44,000 crore ? of transfer pricing adjustments in the past year alone won’t explain the whopping 79% increase in the aggregate amount stuck in disputes and litigation. Nor would the over R11,000-crore tax demand on Vodafone justify the sharp increase in disputed amount of R1.93 lakh crore in a single year, even if one presumes the telecom major’s case was included in the disputed category for the reporting year 2010-11.

Analysts believe the surge in disputes reflects all-round efforts by the revenue department to mop up revenue ? by using the annual information returns (AIR) database of high-value transactions and the facility of integrated computer systems that allow cross-verification between direct and indirect tax databases to identify tax evaders and those who underpay.

Inefficiency at the dispute resolution stage ? the commissioner of income tax-appeal (CIT-A) and the I-T appellate tribunal ? could be part-reason for pile-up, as the plethora of fresh cases makes their tasks harder. The bulk of the pendency is with these two agencies at present, although data suggest larger cases are increasingly reaching courts.

Although a break-up was not immediately available, sources familiar with tax administration said new disputes mostly involve individual taxpayers rather than corporates, while traditionally, the two heads added disputes in roughly the same measure.

In fact, the number of fresh cases that have gone to the ?under dispute? category has shot up after the global economic crisis pulled India’s GDP growth down in 2008-09, denting the impressive revenue buoyancy of the previous three years. The amount under dispute between one to two years used to linger around R25,000 crore for a few years until 2007-08, but it began to increase at a higher pace ? to R29,000 crore ? in 2008-09, before rocketing to R42,000 crore in 2009-10 and further to R50,000 crore in 2010-11.

As per receipts budget for 2012-13 revealed with the latest Budget, ?revenues (direct and indirect taxes) raised but not realised? stood at R1.9 lakh crore at last count, up 50% over the level a year ago.

The receipts budget looks incompatible with the exclusive data on direct taxes which the government gave Parliament because the former excludes cases before the dispute resolution panel where the assessment order is not deemed final.

So, technically, until a case reaches a tribunal/court, a ?dispute? is not recognised.

The receipts budget reveals amounts not under dispute (yet not realised) too, which include cases pending for adjudication. The amount under this category also shot up from Rs 46,000 crore in 2008-09 to Rs 51,000 crore in 2009-10 and Rs 61,000 crore in 2010-11. Going by the finance minister’s reply to an un-starred question in Parliament last month, the amount under disputes has risen meteorically since March 2011. Obviously, the government is making a strenuous bid to improve the tax-to-GDP ratio which fell from the peak of 11.9% in 2007-08 to a low of 9.5% in 2009-10 and is slightly above 10% now.

Conventionally, most tax disputes took two-to-three years for resolution but given the spurt in disputes due to the department’s newfound aggression, the pipeline could now get clogged further.

?Aggressive taxation is not a good thing for the economy at the current juncture, where what businesses need is predictability and certainty about their tax liability,? said Rahul Garg, executive director at PwC.

On the positive side, the new dispute resolution mechanism of advance pricing agreement (APA) to be effective from July, is expected to slacken the pace of addition to disputes from the transfer pricing cases. ?Apart from APAs, there should be detailed guidelines for transfer pricing assessment that would help reduce administrative differences and produce reasonably similar outcomes in similar cases,? said Ernst & Young tax partner Vijay Iyer.