Trading in gold exchange-traded funds (ETFs) on Akshaya Tritiya was lowest in at least five years as subdued investment demand and central bank RBI’s gold import restrictions hit sentiments.

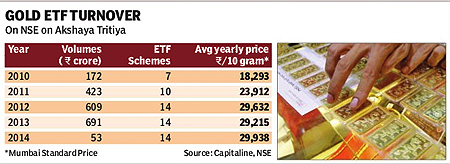

Gold ETF turnover on NSE stood at R53 crore compared with R608 crore last year. Both the exchanges extended the trading hours for gold ETFs till 7 pm on Friday, with BSE waiving the transaction charges for trading in the product.

?The investment sentiment remains weak and there is a limited availability of gold with mutual funds owing to the restrictions on gold imports. Both these factors have played a part in subdued volumes this year,? said Lakshmi Iyer, CIO (debt) & head, product, Kotak MF.

Fund houses have been reluctant to accept fresh inflows into the gold ETF following RBI’s new guidelines, issued on July 22 last year, aimed at restricting gold imports. The new guidelines have made it difficult for fund houses to source physical gold as banks have decided to stop selling gold to MFs. Unlike previous years, fund houses have avoided promotions to push gold ETFs to investors ahead of the auspicious day.

Some experts believe it is the lack of demand rather than import restrictions that has affected trading in gold ETFs. ?Gold has underperformed other asset classes like equity in past few months and is unlikely to see the kind of spurt witnessed in the last 4-5 years. This has dampened sentiments,? said Kishore Narne, associate director, commodities, Motilal Oswal Financial Services.

Average yearly gold prices per 10 gram, as per the Mumbai Standard Price, have remained stagnant at around R29,000 levels in last two years. Average gold prices for CY13 fell 1.4% compared with gains of about 9% seen by Sensex.

Interestingly, SPDR Gold Trust ? the biggest gold ETF in the world ? saw its holdings fall 2.39 tonne to 785.55 tonne on Thursday, after losing 4.19 tonne on Wednesday. SPDR flows, closely watched due to the size of the fund’s holdings, are a good measure of investor sentiments.

Gold ETFs saw net outflows in 11 of the 12 months of FY14 totalling R2,294 crore, according to data from industry body Amfi. This compares with inflows of R1,414 crore in FY13, R5,142 crore in FY12, R7,552 crore in FY11 and R8,402 crore in FY10. Assets under management (AUM) for the category at the end of FY14 stood at R8,676 crore, down 25% from R11,648 crore year ago.

The global demand for gold dropped for a second consecutive year in 2013, to its lowest since 2008. As per the World Gold Council data, in 2013, the total annual consumption in 2013 fell by 15% to 3,756 tonne as the investment demand through exchange-traded products fell for the first time in a decade. Amid stringent import restrictions that weighed on the gold imports to India in the second half of the year, China overtook India as the world’s biggest consumer of physical gold in 2013.