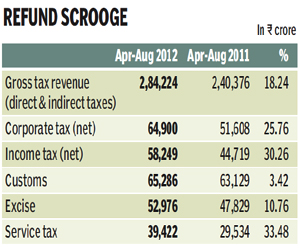

In its anxiety to cut the deficit, the government is turning stingy on tax refunds. During April-August, net corporate tax receipts rose 25.76% to R64,900 crore, according to Controller General of Accounts (CGA) data. This contrasts with gross collections growing just 0.15% to R96,738 crore during the period, as revealed by the revenue department recently.

While industry sources complain that delayed refunds affect liquidity, the government too is expected to pay the price in subsequent years in the form of a 6% annual interest cost.

While industry sources complain that delayed refunds affect liquidity, the government too is expected to pay the price in subsequent years in the form of a 6% annual interest cost.

In the first five months of the fiscal, the government refunded R31,838 crore to corporates, compared with R44,989 crore in the same period a year ago. Refunds during the whole of last year stood at R72,958 crore.

Refunds on personal income tax too declined in the April-August period this fiscal R9,171 crore from R12,863 crore given in the same period a year ago. Net personal income tax receipts rose 30% in the April-August period to R58,249 crore, an improvement from the 12.6% growth recorded in the same period a year ago.

?At a time when capital is expensive, receipt of any amount by way of refund that was outstanding will improve the overall liquidity of a company and help reduce borrowings,? said Rajiv Chugh, partner, Ernst & Young.

Gross corporate tax receipts remained sluggish as economic growth slowed to 5.5% in the first quarter this year compared with 8% the same time a year ago, depressing corporate profits. The finance ministry had projected a 13.9% jump for this year but recent economic data, including a 0.1% contraction in industrial output during April-July have cast doubts over the target.

Sunil Shah, partner, Deloitte, Haskins & Sells said while there was a fall in refunds in absolute terms, it was hard to say the entire jump in net direct tax receipts was on account of refund delays. It may be possible for the government to hold that the taxes collected in many cases were actually what were due.

Indirect tax receipts showed a mixed trend in the meantime. While service tax collection rose 33% in the first five months of this fiscal, customs duty collection inched up marginally by 3.4% and excise duty by 10.8%. The CGA data say total tax collections in April-August grew 18%, closer to the budget target of 19.5% growth.