Several top diversified equity MF schemes, which manage the most by way of assets under management (AUM) and had a dismal run in calendar year 2013, have made a comeback in CY14, thanks to sustained gains made by the equity market.

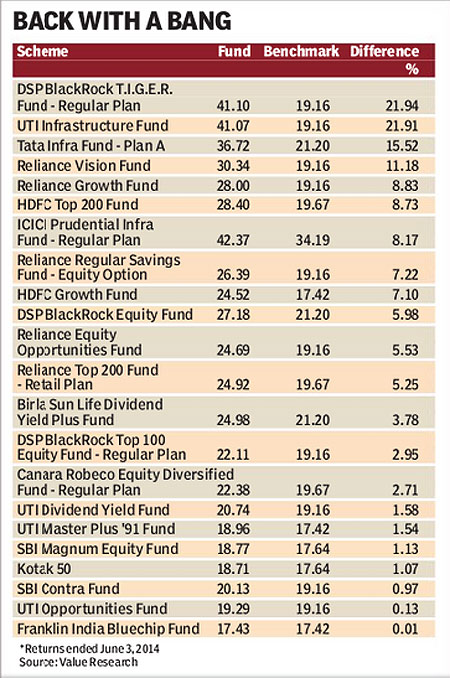

As many as 22 out of a total of 50 top diversified equity schemes have beaten the benchmark indices this year, analysis of data collated from Value Research shows. Collectively, these schemes manage more than R50,000 crore by way of AUM. After underperforming in CY13, HDFC Top 200 Fund, which alone manages more than R10,000 crore by way of AUM, has beaten its benchmark by more than 8% this year. The scheme had underperformed its benchmark by 0.33% in CY13.

Reliance Equity Opportunities Fund, Franklin India Bluechip Fund, Reliance Growth Fund, UTI Opportunities Fund, UTI Dividend Yield Fund, DSP BlackRock Top 100 Equity Fund – Regular Plan, Reliance Vision Fund and Reliance Regular Savings Fund – Equity Option are some of other large funds that have beaten their benchmarks this year. All these schemes have an AUM of more than R2,000 crore.

Infrastructure funds, in particular, have made a sharp comeback. UTI Infrastructure Fund, Tata Infrastructure Fund – Plan A and DSP BlackRock T.I.G.E.R. Fund – Regular Plan, for instance, were the top three underperforming funds among these 50 funds in CY14, lagging their benchmarks by anywhere between 15% and 17.3%. In CY14, these same funds have emerged top outperformers, beating their benchmarks by anywhere between 15.5% and 21.9%, respectively.

Several of these schemes benefited by their exposure to banking stocks. For instance, both HDFC Top 200 Fund and DSP BlackRock T.I.G.E.R. Fund – Regular Plan have over 30% of their portfolio concentrated in Financials as of March 31, 2014. Similarly, schemes such as Tata Infrastructure Fund – Plan A, Reliance Regular Savings Fund – Equity Option and Reliance Growth have more than 20% of their portfolio invested in Financials.

?Exposure to financials, cyclicals, which have significantly run up this year, has helped boost the returns of these schemes. Also, several of these schemes have brought down their cash exposure in the March quarter, which has helped them to take full advantage of the pre- and post-election rally,? said Sameer Hassija, senior investment consultant, Morningstar India.

Bank Nifty has gained 35.5% this year and is now trading near its all-time highs. According to a June 4 report by Morgan Stanley Asia/Pacific Research, Indian financials are likely to be among the best performers across EM banks over the next five years.

The Reserve Bank of India in March extended the deadline for the full implementation of the Basel III norms by a year to March 31, 2019, providing a breather to PSU banks. Under the Basel III norms, a banks’ tier I capital must be at least 7%, while the total capital (tier 1 + tier 2) must be at least 9% on an ongoing basis.