Market experts have maintained their cautious stance on the public sector banks (PSBs) post the Q3 results.

Although all banking stocks have sustained a discount to their long-term average valuations for most part since 2013, deteriorating financials of public sector lenders have weighed heavily on the pack. Due to slow loan demand, asset quality concerns and weak profitability, most analysts keep a preference for the private sector banks.

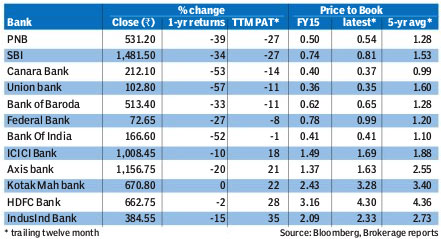

It is not surprising then that the PSBs currently trade at 50-60% discount to their historic trailing twelve month valuations (price to book).

Leading PSBs like State Bank of India (SBI), Punjab National Bank (PNB) and BoB are currently valued at less than half the current value of smaller private sector banks like Federal Bank and Indusind Bank.