Not keeping secrets with certain people is always the best thing to do and so is the case with the Income Tax Department. Hence declaring your incomes, whether or not they are chargeable to tax, is always the best option so that the Income Tax Department does not get a chance to be suspicious of you at a later stage. We have explained here the importance of declaring your exempt income in your income tax returns.

Exempt Income vs Tax Deduction

As per the income tax law, there are certain types of income that are exempt from taxes, referred to as “Exempt Income”. For example, income earned from interest on NRE deposits. This means that no tax is due on the income from the exempted income group. Exempt income differs from tax deductions. Tax deductions are offered on earned income to reduce the total liability for the financial year. A taxpayer can invest in schemes such as EPF, life insurance premiums etc. and reduce the amount invested under Section 80C from their taxable income for the year. For example, if a taxpayer were to invest Rs 1 lakh in EPF, then he/she can reduce this from their taxable annual income for the year, thereby reducing the amount of taxes owed.

Also Read: Income Tax Return filing: What is clubbing of income in IT returns?

What Counts as Exempt Income

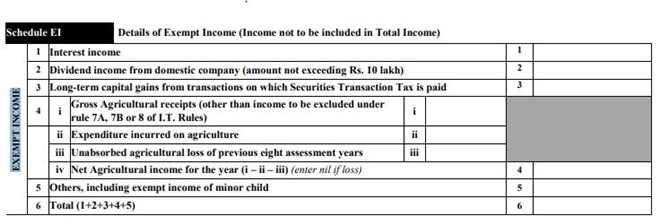

Most of the exempted income falls under Section 10 of the Income Tax Act. Income such as those from capital gains from sale of mutual funds and shares, agricultural income, scholarship grants and much more. Below is a list of a few commonly-exempted incomes:

1. Salary allowances such as HRA, LTA: For example, if you spend 20k on LTA, then your employer can deduct this amount from your annual taxable income to reduce your tax liability. For example, if your annual income is Rs 4,00,000, then after your LTA deduction, your taxable income would only be Rs 3,80,000.

2. Mutual Funds/Stocks/ Shares Capital Gains: If you were to sell your stocks, for example 2 years after purchase, the profit made from the sale would count as LTCG, which is exempted income. By declaring this income, and later if you were to use the profits to buy a car for example, you could prove the source of income for the purchase, if the ITD should choose to audit your accounts.

3. Capital Gains Exemption: There are certain exemptions provided u/s 54, 54F, 54EC, etc as per which you can claim the gain on sale of certain capital asset as exempt from tax subject to certain conditions. But it is important that you report this gain in tax return and fill the complete details of the exemption applicable in your case. Else there are high possibility that you will receive a tax notice.

4. Dividend Income: Dividend received from an Indian company is generally exempt, but if the amount of such dividend exceeds Rs 10 lakh in a year, then the amount exceeding Rs 10 lakh will become taxable at 10%.

5. Withdrawals or maturity proceeds of PPF, EPF, VPF: While the amount at maturity is exempt in case of PPF, the amount withdrawn from EPF is tax exempt if you have completed five years of continued service with the employer.

6. Interest in savings bank: Interest earned on a savings bank account can be claimed as tax free by claiming a deduction u/s 80TTA. But for claiming this deduction, it is important that you report interest earned on all your savings accounts under the head ‘Income from other source.’

Also Read: Income Tax Return filing: What is Electronic Verification Code, How to generate EVC to e-verify return?

7. Interest in NRE account: The interest earned by NRI on their NRE account in India is tax free in India. But reporting this interest will build your financial record with the tax department which can help the department to establish the sources of your high value investment.

8. Life Insurance amount on maturity: Under Section 10(10D), amounts received by a Life Insurance Policy or bonus amounts are exempt.

9. Gift amount on marriage/inheritance: There is no cap on the amount received on marriage or through inheritance and is tax exempt. But if you receive any gift from a non-relative in a financial year in excess of Rs 50,000, then the entire amount becomes taxable.

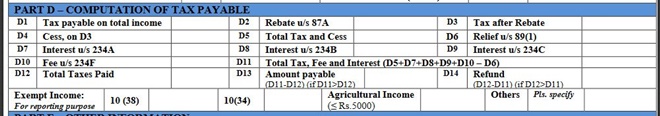

10. Agricultural Income: If income is under Rs 5,000, then it is exempt. However, it will still need to be declared in ITR1. If it is above Rs 5000, then it must be declared ITR 2. The agricultural income for the year must be declared along with income from other sources. So, if you earn Rs 3,00,000 from other sources and Rs 1,00,000 from agriculture, then your total income for the year is Rs 4,00,000 for the purpose of calculation of tax rate applicable on income other than agricultural income.

Agricultural income is taken into account for rate purposes while computing the income tax liability, if following two conditions are cumulatively satisfied:

# Net Agricultural income exceeds Rs 5,000/- for previous year, and

# Total income, excluding net Agricultural income, exceeds the basic exemption limit.

Not declaring your agricultural income to reduce your tax liability could see you being penalized for non-disclosure of income.

Declaring Exempt Income

Although the above-mentioned sources of income are exempt from taxes, it is always best to declare all income to avoid a tax notice or inquiries from the tax department. Exempted income is declared in ITR1 in the exempted income section, such as Long Term Capital Gains (LTCG), which is exempted u/s 10(38).

ITR-1

Certain exempted income is declared in the ITR-2 as well, such as agricultural income above Rs 5,000.

Consequences of not Disclosing Income

Although certain income sources do not attract tax, but by not declaring the source of income, taxpayers may find themselves being scrutinized by the Income Tax Department. At that time, if a taxpayer cannot explain the source of income, then he/she may be penalized. For example, if in the future there is a large value transaction against your PAN, the ITR would have a record of your exempt income from various sources, which you would also be able to prove as the source of income for the cash deposit. Therefore, to avoid any unforeseeable situations, a taxpayer should declare all exempt income for the financial year in his/her annual tax return.

(By Chetan Chandak, Head of Tax Research, H&R Block India)