Tata Consultancy Services (TCS) on Friday said it was likely to witness a nominal decline in operating margins in Q1FY15, largely due to a forex impact and wage hikes. Moreover, the software major indicated the appreciation in rupee in the quarter was likely to impact the company’s topline.

?Our Q1 revenue outlook remains unchanged with most of the larger verticals likely to deliver growth in line with historical averages while the smaller and medium verticals like media and lifesciences will deliver better than average growth,? Rajesh Gopinathan, CFO, said.

Gopinathan, added that given the changes in the exchange rate, there is likely to be 300 basis points (bps) impact on the revenue line in rupee terms, even as there may be 50 bps improvement in revenue growth in constant currency terms.

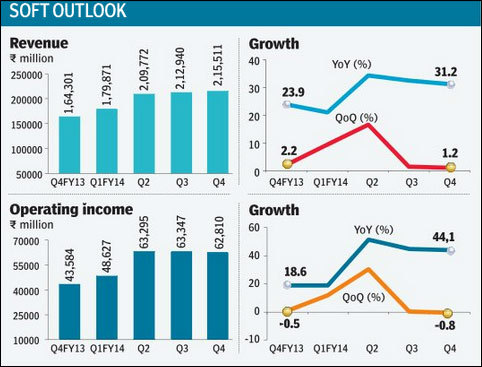

On a business update call with investors, TCS said the June quarter?s operating margin may be affected by 100 basis points due to forex fluctuations though the targeted Ebit band remains unchanged. The software major had in Q4FY14 reported an Ebit (earnings before interest and tax) margin of 29.15%, down 60 bps on a sequential basis.

TCS chief financial officer Rajesh Gopinathan said the company?s earnings could also be affected by a one-time depreciation charge it will be making to align its depreciation policy with new Companies Act.

?We are revisiting and rationalising our depreciation policy in view of the current structure with a change in the treatment of depreciation method and life of assets. As a result, there would be a one-time impact on both IFRS and Indian GAAP statements though different in quatum and direction. While IFRS would see a depreciation charge of 2% on the overall net block, there would be writeback amounting to 4-5% of fixed assets in case of Indian GAAP,? Gopinathan added.

TCS would be migrating from its earlier reporting, based on straight line depreciation method for some of the assets and written down value method for others to a straight line method for its assets. There is likely to be some improvement in the other income due to its higher cash and bank balances that stood at R14,442 crore (Indian GAAP) at the end of FY14.

The dollar to rupee forex rate has so far this quarter (April to June till date) averaged at 59.79 against an average of R61.53 in the fourth quarth of fiscal 2014. Gopinathan said that the US and Europe continue to witness steady growth with project led demand in the US and outsourcing demand in Europe continue to remain strong. India, however, may witness flattish growth.