The UPA government’s reform agenda received a shot in the arm on Friday as a motion against the proposal to allow foreign direct investment (FDI) in multi-brand retail was defeated in the Rajya Sabha, with Mayawati?s Bahujan Samaj Party voting in favour of the government.

Emboldened by its victory in both Houses of Parliament (it won the vote on FDI in retail and related amendments to regulations in the Foreign Exchange Management Act in the Lok Sabha on Wednesday), the government expressed confidence that it may be now be able to push more reforms in banking, insurance and pension sectors in the remaining 10 days of Parliament?s winter session.

Emboldened by its victory in both Houses of Parliament (it won the vote on FDI in retail and related amendments to regulations in the Foreign Exchange Management Act in the Lok Sabha on Wednesday), the government expressed confidence that it may be now be able to push more reforms in banking, insurance and pension sectors in the remaining 10 days of Parliament?s winter session.

?Certainly, we are going to bring in more legislation in coming weeks in Parliament and we will be engaging all political parties on it,? an exuberant parliamentary affairs minister Kamal Nath said after the FDI vote in Rajya Sabha.

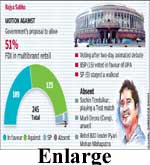

A total of 123 Rajya Sabha members voted against the motion ? moved by AIADMK member V Maitreyan ? opposing 51% FDI in multi-brand retail, while 109 voted in favour. This sets the stage for global supermarkets like Walmart and Stockmann to enter the country?s fast-growing, $450-billion retail sector.

Stock markets largely ignored the news with the Sensex closing 63 points lower at 19,424.10 on Friday, possibly as the victory was discounted into the stock prices. The government justified FDI in multi-brand retail as being beneficial for the economy; drawing foreign investment, helping set up efficient supply chains, reducing wastage and combating inflation. The government rejected the Opposition?s stand that the move would hit small retailers and kirana shops.

The government?s victory in the Rajya Sabha, where the UPA lacks a majority on its own, came with the help of the 15-member BSP, which had walked out of the Lok Sabha during voting on the issue but voted with the government. The Samajwadi Party, which has nine members in the House, staged a walkout expressing dissatisfaction over commerce minister Anand Sharma’s reply. The UPA has 94 members in the Rajya Sabha, which has an effective strength of 244.

Sachin Tendulkar, the nominated member who is playing Test match in Kolkata, Murli Deora (Congress), who is unwell, and rebel BJD leader Pyari Mohan Mahapatra were absent.

But their absence did not create any problem for the ruling alliance.

With the government crossing a big hurdle by getting parliamentary approval for the FDI proposal, all eyes would now be on the remaining pieces of economic legislation that has also seen sharp divisions on party lines. The amendment Bill to increase the FDI cap in insurance from 26% to 49% has already found stiff opposition with a parliamentary standing committee rejecting any move to hike the cap. Parties are also divided over the issue of allowing FDI in pension and opening up the sector to competition.

The BJP, the principal opposition party, has made its intention clear. is likely to oppose raising FDI cap in the insurance sector to 49%. ?We will oppose any move by the government against the recommendations of the standing committee on finance, which has said it (the FDI cap in the insurance sector) should be 26%,? Prakash Javadekar, a BJP leader and spokesman for the party said. To carry on with reforms, the Congress-led UPA will have to rely on the support of Uttar Pradesh-based parties BSP and SP.

Parliamentary approval to FDI in multi-brand retail paves the way for states including Haryana, Maharashtra, Delhi, Andhra Pradesh, Rajasthan, Uttarakhand, Assam and Manipur, which have favoured the government’s decision, to take forward steps to invite investments. They would, however, have to wait for some more time as the Centre would first come out with a set of rules for the trade. A total of 11 states had supported FDI proposal, seven had opposed while three sought more time.