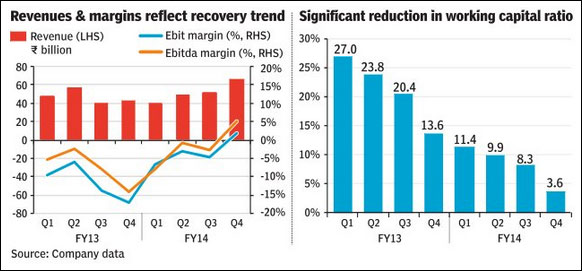

FY14 concludes with signs of recovery: After seven quarters of consecutive losses, Ebitda and Ebit were positive in Q4FY14, reflecting early signs of a turnaround. Also, in May 2014 Suzlon Energy Ltd announced it had reached an agreement with foreign currency convertible bond (FCCB) holders on the bond restructuring. The restructuring is likely to conclude in two months, enabling the company to be technically out of ?default?.

Improving performance: During FY14, Suzlon (ex-Senvion) sold 723MW of wind turbines compared with 251MW in the previous year. As a result, the group?s revenue rose 8% y-o-y to R205 bn, despite a 19% decline in Senvion?s revenue. On a consolidated basis, the company posted positive Ebitda and Ebit due to continuous cost-reduction efforts.

Significant reduction in working capital: By end-March 2014, Suzlon managed to cut its working capital to 3.6% of sales (470 basis point reduction q-o-q), reflecting a significant improvement over the past eight quarters. The company has adopted a ?just-in-time? inventory approach to achieve these target reductions. Its outlook for working capital ratio in FY15 is 3-5% of sales.

Senvion?s margins expand: Senvion continues to be profitable with a FY14 Ebitda margin of 8.1% and Ebit margin of 5.6%. Ebitda jumped 25% year-on-year despite a revenue decline of 19%. This improvement in margins is due to the focus on high-margin markets, business restructuring and effective working capital management. Looking forward, the focus on the offshore wind market should help the company further improve its realisation and margins.

FCCB restructuring agreed: In May, Suzlon announced that that it had reached an agreement with the FCCB holders on bond restructuring, contingent to approval from the RBI. The new restructured bonds will have a maturity period of five years and one day from the date of issue, and are payable in FY19-20. The conversion price of bonds is fixed at R15.46, which is 10% above the regulatory floor price.

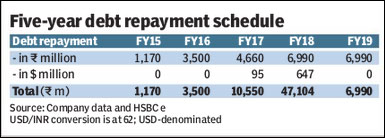

No significant repayments in next two-to-three years: Suzlon?s gross debt as of end-March ’14 stands at R170 bn. This includes R90.1bn of rupee debt and the remaining is US dollar-denominated debt. The repayment schedule for the next five years highlights that the first large repayment of R47 bn is due in FY18.

Order book continues to be strong: As of end May 2014, the company?s order book was 5.3GW ($7.6bn), which is nearly at the last year level of 5.6GW ($7.5bn). The current order book includes offshore orders of $1.2bn.

Geographic distribution: The order book includes $1.3bn of emerging market order book (India, Brazil, Turkey and Uruguay) and the remaining $6.3bn is from developed markets. The developing market order book will be serviced by Suzlon and the remaining by Senvion.

2,275MW of orders received during the year: On a y-o-y basis, the new orders of 2,275MW reflect a decline of 33%. Total orders during H2 of the current year were 1,524MW versus 751MW during H1. Home countries Germany and India continue to have the largest share in terms of order book. We expect to see new orders in India during the H2.

Liquidity likely to improve: We earlier mentioned that a recovery in investor sentiment post-elections would support Suzlon?s asset sale programme. Suzlon is now targeting R10 bn of asset sales in FY15. We expect the new government to provide a boost to the country?s renewable sector. This will help improve liquidity at Suzlon, thereby supporting the company?s turnaround. Further, Suzlon CFO recently mentioned in an interview that the company is looking to list Senvion (erstwhile REpower) by March 2015.

Order book continues to be strong: During the year, the group received new orders of 2,275MW. The improvement in liquidity will enable Suzlon to deliver on its current order book and also get new orders, which have dried up after the FCCB default.

New target price of R37: Based on the observed performance in FY14, we raise our medium- to long-term forecasts. This is primarily driven by an increase in our volume sales assumptions, though we lower our margin assumptions. Our revised EPS forecasts for FY16/FY17 are R1.55/ R3.26 (R1.11/R2.17 earlier). Our numbers are significantly above consensus. Using DCF valuation, we get a stock fair value of R37.18. We also remove the 10% discount to our DCF value, which was earlier provided for poor visibility on cash generation from asset sales. This gives us our rounded target price of R37 per share (R18 earlier); we retain our OW(V) rating.

HSBC