TITAN’s Q1FY19 revenue (up 8.2% y-o-y) came slightly below while Ebitda (up 27.4% y-o-y) and PAT (up 27.3% y-o-y) were ahead of our expectations. Jewellery division growth though impacted by high base, still was soft at 5.7% y-o-y. Despite market share gains for Titan, we believe that 20% plus revenue growth in jewellery will be difficult over FY18-21, considering softer industry growth and low hanging fruits of growth largely done with. Maintain Hold with price target of Rs 920.

Jewellery, topline soft but margins strong

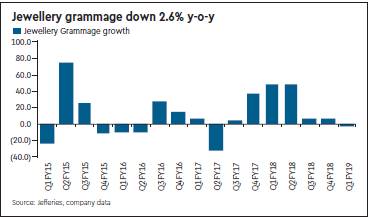

During Q1FY19, jewellery saw sales growth of 5.7% y-o-y coming on a base of 54% y-o-y (GST led preponement of demand to the tune of `2.5 bn). Like to Like (LTL) growth was also soft at 3% y-o-y for Tanishq. Apart from higher base, less number of marriage days and sudden jump in gold prices also impacted demand. Ebit margins improved 100bps y-o-y helped by improvement in studded share which increased 200bps y-o-y to 25% of mix.

Watches, all round strong quarter

Watches sales increased by 20% on a LTL basis (adjusting for GST) coming on base of 2% y-o-y. Margins were strong and increased 930bps y-o-y to 18.8% helped by improved mix (higher sale of Titan brand) and cost control measures. Management, however, does not expect to sustain such high level of margins; it has guided of double digit margins though.

Eyewear, recovering

Eyewear saw good recovery with 16.4% y-o-y (base of 0.2% y-o-y), helped by 44% y-o-y growth in sunglasses. Ebit however continues to be soft at `17 mn in Q1FY19 (against `32 mn in Q1FY18) as company focuses on driving topline.

Conference call takeaways

Industry dipped by 25% during Q1FY19, also impacted by lower wedding days. July saw 40% y-o-y growth in jewellery though on a depressed base.

View and PT

We keep our estimates largely unchanged and maintain our Hold on the stock with revised price target of `920 as we roll over to June 20e EPS. We maintain target multiple of 45x to the stock. Titan though will be the biggest beneficiary of the market share gain from the large unorganised segment, we believe most of the low hanging fruits of growth such as exchange gold and GHS have been enjoyed. Also, given high consensus expectations and limited scope for further re-rating, we see unattractive risk-reward at current price.