We met Jubilant Foodworks? CFO and following are the key takeaways:

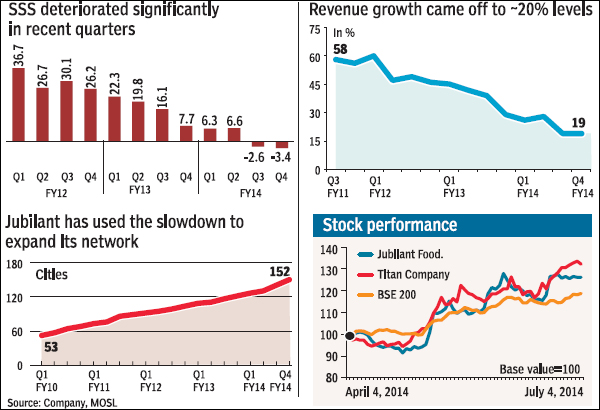

n Demand recovery to be gradual: Refraining from offering any specific SSS (same store sales) guidance, Jubilant (JUBI) management indicated soft demand and a gradual pick-up in H2FY15, on the basis of improvement in the economy. Frequency of ordering by existing customers has declined marginally to less than four times per annum. For demand to improve, macro parameters like disposable income need to pick up for its core target group of Sec A/B.

n Margin recovery?a function of SSS revival: JUBI?s margin recovery will be contingent on revival in SSG (store sales growth). New stores operate at lower productivity vs existing ones, and hence in an environment of low SSG plus aggressive store expansion, margin performance has been subdued (JUBI?s operating margin contracted from 18.5% in FY12 to 14.8% in FY14). As the proportion of new stores decline, we expect margin pressures to moderate. We build 50basis point and 40 bp expansion in FY15e and FY16e to 15.3% and 15.7%, respectively.

n Competition will expand the market: As per the management, in a nascent category like QSR (quick service restaurant), competition is good from a long-term category expansion point even though it may entail short-term margin pressures due to discounting/promotions etc. Entry of new brands/formats will expand the share of wallet for organised QSR industry and take share away from home food.

n Other takeaways: (i) JUBI?s market share has crossed 70% as per latest industry report, (ii) expansion plans: 150 new Dominos and 25 new Dunkin stores per annum for the next three years, (iii) most of the Dunkin stores are profitable at store level. As per management, gross margin of Dunkin is higher than Dominos due to lower food and labour cost, (iv) as per current internal estimates, management sees potential for 1,200-1,300 Dominos stores.

n Valuation and view: Though it may take a couple of quarters for SSS to revive, we believe the worst is behind. We believe JUBI, along with Titan, is the best play on revival of urban discretionary consumption. We factor SSS growth of 7-8% each in FY15e and FY16e, respectively. We had recently upgraded the stock to a Buy. Maintain Buy with a target price of R1,370, valuing it at a P/E (price-to-earnings multiple) of 39x, 15% discount to three-year average. Worsening of macro, spike in input cost inflation remain the key risks.

?Motilal Oswal