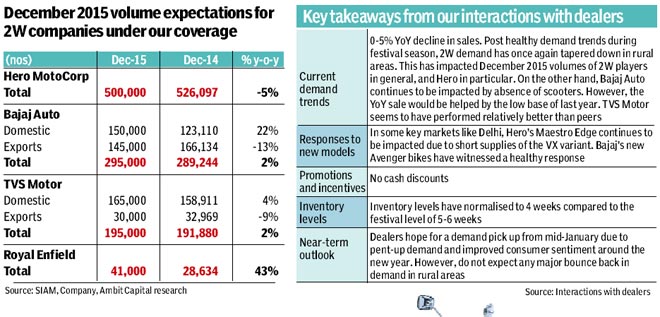

Post healthy demand trends during the festival season, two-wheeler (2W) demand has once again tapered down in rural areas. This has impacted December 2015 volumes of 2W players in general, and Hero in particular. On the other hand, Bajaj Auto continues to be impacted by absence of scooters. However, the y-o-y sale would be helped by a low base of last year. TVS Motor seems to have performed relatively better than peers. Demand is expected to pick up from mid-January due to pent-up demand and improved consumer sentiment around the New Year. However, do not expect any major bounce back in demand in rural areas. For December 2015, we expect Bajaj Auto to report 22% y-o-y growth in domestic volumes (overall growth of 2%), Hero MotoCorp to register 5% y-o-y decline and TVS Motor to fare relatively better with 2% y-o-y growth. Whilst near term growth in 2Ws would remain subdued (5% y-o-y growth in FY16), we are more positive on the long term volume growth potential of the industry (8% over FY15-FY25). This growth will likely be delivered by scooters (FY15-FY20 sales CAGR 18%) and premium bikes (12%) versus commuter bikes (5%). We believe TVSM appears best placed to ride the scooterisation and premiumisation shifts in 2Ws. We maintain SELL on other 2W players.

We carried out dealer checks of 2W dealers across India in the last few days to understand: (i) the demand trend post the festival season (Diwali); (ii) the outlook on demand going forward; (iii) the inventory levels; (iv) trends in competition; and (v) any changes in incentives/discount levels. The key takeaways from our discussions with dealers and our expectation of December 2015 volumes for the large 2W players under our coverage:

Subdued demand trend post the festival season: Dealers highlighted that post Diwali, demand for motorcycles across India has slowed. However, part of this weakness is also attributable to the seasonal trend. Demand tends to remain weak in December. The demand in certain regions has also been impacted by weak monsoons. However, most dealers are hopeful of some revival in demand from mid-January onwards driven by positive sentiment around the New Year and as the marriage season kicks in. Dealers indicated that scooters continue to outperform motorcycle volume growth.

Demand impacted in Delhi due to issues around vehicle registration: Dealers in Delhi indicated that demand has been impacted by two main factors: (i) overall weak consumer sentiment; and (ii) notification issued by the Supreme Court which states that vehicle registration numbers would be issued randomly, based on software (VAHAN 4.0), wherein the computer will automatically generate a number for the vehicle (vs earlier method of allotting a series of numbers to a dealer). This has led to delay in delivery of the vehicles as the manufacturing of the number plate takes ~3-4 days (earlier dealers would pre-order number plates based on the series of the number they were allotted). Dealers indicate that this issue will likely be resolved in January 2016 when the delivery of number plates will be done within 24 hours.

TVSM performs relatively better than peers: Our channel checks suggest that of the biggest four 2W OEMs, TVS Motor (TVSM) has performed relatively better than its peers driven by continued healthy demand for its scooter, Jupiter. The Apache segment continues to witness growth driven by launch of new colour variants. However, TVSM’s despatches for December 2015 could be impacted by disruption to the supply chain due to Chennai floods.

Bajaj Auto continues to be impacted by absence of the scooter portfolio. The December 2015 y-o-y volume growth will likely be helped by the low base of 2014. On the positive side, dealers cited a good response to its recently introduced Avenger bikes.

Hero MotoCorp witnessed close to 5%-8% y-o-y decline in December 2015. The company’s recently launched Maestro Edge’s sales have been adversely impacted due to inadequate availability of the VX variant. Dealers indicate that customer demand has been skewed towards VX variant (the price gap between VX and LX variant appears too low for the additional features available with the VX variant) whereas company’s supplies were more towards the LX variant.

No cash discounts: The 2W space continues to be free of cash discounts. A few dealers indicated that insurance is currently offered free for bookings done through online portals like Snapdeal.

Inventory levels have normalised: Inventory levels have normalised post the festival season to around four weeks.

Where do we go from here?

In our sector note dated November 23, 2015, (Short-lived festivities) we had highlighted that we are circumspect of the recovery sustaining in the coming months. Our belief is based on the following factors: (i) rural economy continues to witness the macro headwinds of weak monsoons (FY16 and FY15), moderation in Government spending and lower crop prices; (ii) festival sales spurt in rural areas was mainly driven by pent-up demand and that demand has again moderated post the festival season; (iii) sales in southern India (Tamil Nadu) has been impacted due to heavy rains.

In our 2W thematic, we indicated that whilst near term growth in 2Ws would remain subdued (5% y-o-y growth in FY16), we are more positive on the long term volume growth potential of the industry. We estimate the domestic 2W industry to post 8% volume CAGR over FY15-FY25 in states comprising ~58% population. However, this growth will likely be delivered by scooters and premium bikes (12%) as against commuter bikes (5%).

We believe TVSM appears best placed to ride the scooterisation and premiumisation shifts in 2Ws. Market share gains from strong product cycle, continued strong response to Jupiter, are likely to drive 13% volume CAGR over FY15-FY18. Furthermore, positive reviews regarding G310R and its imminent launch in mid-FY17 make us factor in BMW tie-up benefits. We retain our BUY stance on TVSM. We expect Bajaj Auto’s premium segment market share to witness rising competition. Macro issues and increasing difficulty in market share gains in export markets may restrict export volume growth. Uncertain product development capabilities and low exposure to scooters/premium bikes make Hero the most vulnerable in domestic 2Ws. We maintain SELL on Hero and Bajaj.