Of a total 65 equity schemes, 54 schemes have given negative returns in the last one year. Only two schemes of a universe of 34 mid-cap and small-cap equity schemes have given positive returns over the last one year. Again, 22 out of a universe of 31 large-cap equity schemes have posted negative returns.

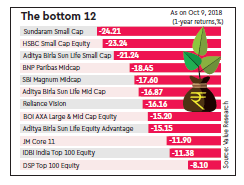

Sundaram Small Cap Fund, HSBC Small Cap Equity Fund and Aditya Birla Sun Life Small Cap Fund are among the worst-performing equity schemes over the past year, having lost anywhere between 21% and 24%. Several large-cap funds such as JM Core 11 Fund, IDBI India Top 100 Equity fund and DSP Top 100 were laggards among the large-cap category, giving negative returns in the range of -8 to -11.90%.

In the mid-cap segment, schemes such as BNP Paribas Midcap Fund and SBI Magnum Midcap Fund have dipped by 18.45% and 17.6%, respectively, in the last one year.

Average returns of mid-cap funds is -11.56% and small-cap schemes is -14.79% in the last one year, shows data from Value Research. Of 21 mid-cap equity schemes and 13 small-cap schemes, only one scheme each has given positive return in the same period. While the Sensex is up by 8.8% in the last one year, average returns of large-cap funds have fallen by 2.74%.

With more than 80% of all stocks in the red since the start of 2018, most mid-cap and small-cap equity schemes have posted negative returns. A study by FE shows that out of 725 companies with market capitalisation of `1,000 crore or more, 425 companies have lost more than 20% of their value since January. From the universe of 31 large-cap equity schemes, 16 schemes have managed to outperform the average.

The Sensex gained 8.8% in the last one year but was driven by a handful of stocks. However, there has been a fall in broader indices in the last three months, which has led to slower average monthly inflows into equity schemes. Data from Association of Mutual Funds in India shows that the average monthly inflows into equity schemes in H1FY19 fell to `10,080 crore from `14,200 crore in 2017-18. Equity funds (which includes equity, ELSS and arbitrage funds) saw inflows of `11,251 crore in September; this is higher than the `5,923 crore in August, which was an 18-month low.

S Krishna Kumar, chief investment officer – equity at Sundaram Mutual Fund, said, “If we look at the large-cap rally, it was driven by few set of stocks on the Nifty side which included few banks names and top IT companies, it was not a very diversified rally on the large-cap side. For the mid and small index both were highly valued in December last year. But with recent correction, both mid- and small-cap stocks have once again turned attractive.”

Market participants also say that investors have started stopping their SIPs in equity funds due unstable equity markets. SIPs are largely being closed by investors who have invested directly in mutual funds, without the help of distributors or independent financial advisors (IFAs). A CEO of one of the mid-size fund houses said, “Despite sharp fall in equity markets in the month of September, investors have continued to faith in SIPs. But I fear in the months to come we might witness SIPs getting closed as investors start seeing negative returns in their funds.” High volatility in the equity markets is also one of the reasons why investors are stopping their SIPs. The data from Amfi shows that the contribution of SIPs in September is the highest at 7,727 crore. In the six months of the current fiscal, total SIP contribution is `44,487 crore.

A SIP is an investment plan offered by fund houses wherein investors can invest a fixed amount in a mutual fund scheme periodically at fixed intervals — say, once a month, instead of making a lump-sum investment. SIPs are similar to a recurring deposit where you deposit a small or fixed amount every month.

In the financial year 2016-17, total SIP contribution in the industry was `43,921 crore. It increased to `67,190 crore in financial year 2017-18, shows data from Amfi. The industry’s assets under management (AUM) were `22.04 lakh crore, a fall of 12.5% over the `25.20 lakh crore in August.

Market participants say that many investors started coming in mutual funds through SIPs in 2014-15, when equity markets were on a rise. “There were investors who just looked at the past performance of equity schemes and particularity in mid- and small-cap schemes, which were at that time giving very high returns. But now with sharp correction in mid- and small-cap stocks, investors will start pulling out money or stop their SIPs in the coming months,”said a marketing head of the leading fund house.