Arbitrage funds have been the best performers in the last 12 months, clocking the highest post-tax returns. With the increased volatility in the equity markets in the last one year, these funds have been able to benefit on the arbitrage advantage between the cash and derivatives segments.

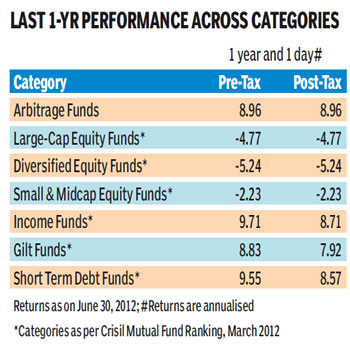

An analysis by Crisil shows that between July 2011 and June 2012, arbitrage funds gave post-tax returns of 9% against 8.4% for debt funds and -4.1% for equity funds. The analysis is based on the performance of eight arbitrage funds.

Arbitrage funds are a niche category, which tries to take advantage of the price difference between cash and futures (derivatives) markets to generate returns. The ability of these funds to generate higher returns depends on the volatility in equity markets ? the higher the better.

Arbitrage funds are a niche category, which tries to take advantage of the price difference between cash and futures (derivatives) markets to generate returns. The ability of these funds to generate higher returns depends on the volatility in equity markets ? the higher the better.

Over the past one year, the equity markets have been volatile, thereby creating opportunities for such funds to generate high returns. As arbitrage funds predominantly invest in equities, they are treated on a par with other equity funds for tax treatment.

Experts believe that risk-averse investors who shy away from equities owing to high volatility can look at arbitrage funds as a relatively safer option within equities.

?Arbitrage funds have a low risk-return trade-off and generate moderate returns,? says Jiju Vidyadharan, director ? funds and fixed income research? Crisil.

?Arbitrage opportunities to be exploited depend upon the extent of volatility in the equity market ? the higher the volatility, the higher the returns. During the volatile 2006-2008 period, arbitrage funds gave healthy post-tax returns of 8-9%.? The category has also provided higher returns in the short term and can act as an alternative to short-term debt funds.

During the past three and six months, arbitrage funds gave post-tax returns of 2.38% and 4.28%, respectively compared to 1.84% and 3.5% for debt-short funds and 1.99% and 3.74% for ultra-short-term funds. ?The dividend option of arbitrage funds is further lucrative as dividends are tax free for equity funds, while short maturity debt funds are subject to a dividend distribution tax? adds Vidyadharan.