UP Board Result 2018 class 10 LIVE Updates: The Uttar Pradesh Madhyamik Shiksha Parishad (UPMSP) has declared the class 10th (high school) and class 12th (intermediate) results today at upmsp.edu.in, upresults.nic.in. Candidates who had appeared for the exam earlier in the year can visit the official website of UPO board in order to check their results. The results are expected to be declared at 12:30 PM today. A total of 66,37,018 students registered for the Uttar Pradesh board examination this year. Out of the total lot, 36,55,691 appeared for the class 10th board examinations, while 29,81,327 students appeared for the 12th exams.

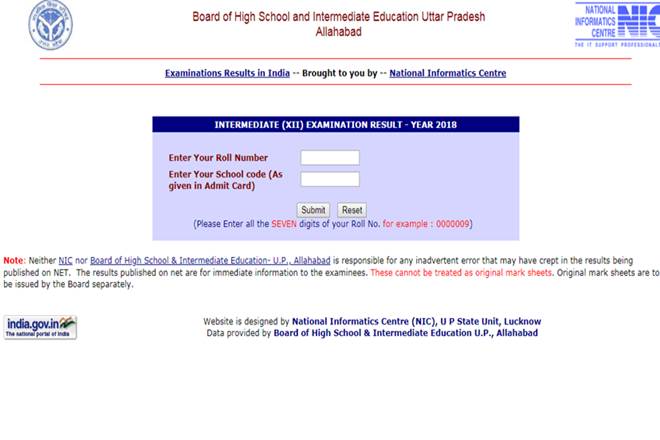

Apart from the official websites, candidates can check their result on indiaresults.com, examresults.net. The students who had appeared for the same can check their results by entering a valid roll number along with other details. After checking the result, the students can take a photocopy of the same.

Also read| UPMSP UP Board Result 2018 Class 10: Date, time, website; all you need to know

This year UP Chief Minister Yogi Adityanath made sure that strict measures were used across all the board examinations centres in the state to prevent any cheating incident. After this announcement was made, it was recorded that a total of 1,80,826 students missed their board examinations.

Also read| Students alert! Check UP Board result 2018 via SMS

UP Board Result 2018 Class 10 LIVE Updates:

5:00 PM: I have always studied as per my time table & gave proper importance to each subject. My school teacher & parents always inspired me to do well. I had self-motivation. I would like to become an NDA officer, says Abhishek Kumar

4:30 PM: Abhishek Kumar secures rank 3 in UP board intermediate exams

4:00 PM: In 2017, Tejaswi Devi of Fatehpur’s Jai Maa SGMIC school had topped the high school (Class 10) exams with 95.83 per cent marks, which was followed by Kshitij Singh and Navneet Kumar of Lucknow Public School who have secured the second position in Class 10 exams.

3:40 PM: Uttar Pradesh Chief Minister Yogi Aditynath has something to say about the today’s results|

#UPCM श्री #YogiAdityanath ने नक़ल विहीन परीक्षा के बावजूद बेहतर परिणाम देने वाले सभी प्रतिभाशाली छात्रों को बधाई दी है और उनके उज्ज्वल भविष्य की कामना की। मेरिट में आने वाले टॉप 10 छात्रों को सम्मानित करने की घोषणा भी की है।

— CM Office, GoUP (@CMOfficeUP) April 29, 2018

रिकॉर्ड समय एक महीने में ही हाई स्कूल और इंटर की नक़ल विहीन परीक्षाएं कराने के साथ सबसे कम समय में परिणाम जारी कराने के लिए परीक्षा आयोजन से जुड़े सभी लोगों को बधाई: #UPCM श्री #YogiAdityanath

— CM Office, GoUP (@CMOfficeUP) April 29, 2018

3:34 PM: Utkarsh from Kanpur bags the 6th rank in UP Board 10th exams, says happy about the result. “My father is a teacher at a government school. I want to become an IAS officer”

3:00 PM: I am very happy to top the exam. I was confident of scoring good marks. Our school teachers helped us to prepare well. My father is farmer who has always supported me, says Anjali.

2:30 PM: While talking about what she wants to do in future, Anjali says that she wants to become an engineer.

2:00 PM: Anjali Verma has emerged as the Uttar Pradesh class 10th topper.

1:24 PM: I am really happy that such a good result has come. I want to congratulate everyone who has passed in these examinations. This time all the exams were held without any complaints of cheating coming from anywhere, says CM Yogi Adityanath on UP Board exam results.

12:55 PM: While the 10th board exam results have been announced, the official website is yet to show the updated information. According to it, the results will be declared shortly.

12: 46 PM: Results of class 12th of UP Board has been announced. The passing percentage of boys is 72.27% & the passing percentage of girls is 78.81%. Rajneesh Shukla & Akash Maurya topped with 466 marks each, says Awadh Naresh Sharma,Board of High School & Intermediate Education Uttar Pradesh.

12:43 PM: Class 10th result now out! Pass percentage of class 10 stands at 75.16.

12: 40 PM: UP Board high school results are expected to be released anytime now

12:30 PM: Uttar Pradesh Class 12th board result now out! Visit the official website to check result.

12:10 PM: UP board 12th result will be declared shortly at upresults.nic.in, upmsp.edu.in. Candidates can visit the official website to check their results. They can even send an SMS to check their results.

11: 46 AM: The UP 10th Board exams were conducted from 6 February – 22 February 2018 and The UP Board 12th exams were conducted from 6 February – 12 March 2018.

11:16 AM: Stay tuned for the board examination results.

10:45 AM: Students can also check their UP Board results via SMS- all they need to do is to enter their 10 digit roll number <UP10ROLLNUMBER> and send it to 56263.

10:15 AM: The official website of Uttar Pradesh results currently shows the message ‘U. P. Board High School (Class X) Examination – 2018 Results likely to be announced on on 29 April 2018 at 01.30 PM onwards’

10:06 AM: The Uttar Pradesh class 10th board examination result will be declared today at 12:30 PM.

UP Board Result 2018 Class 10: Steps to check results-

Step 1. Visit the official website of UP board at upresults.nic.in

Step 2. Now click on the link that says Class 10 results and click on it

Step 3. The result page will open on you computer screens

Step 4. Now enter your details like enrolment number and name

Step 5. Press submit after which your result will appear on your computer screens

Step 6. Take a print out for the future reference

More about UP board result-

Nearly 32 lakh students every year appear for the Uttar Pradesh Board examinations.The UP Board is the largest exam board of the country with over 34 lakh students in class 10th and approximately 26 lakh students in class 12th.