Experts attribute trend to gains posted by benchmark indices in last few months

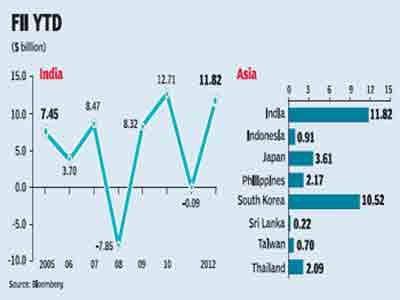

Foreign institutional investors (FIIs), the drivers of the Indian equity market, have pumped in nearly $12 billion in the first eight months of the current calendar year. This is also the highest among most leading Asian economies in 2012.

Market experts attribute this trend to the gains posted by the Indian benchmark indices in the last few months even though the market has seen trade in a narrow range in the recent past. The return on equity in the Indian market is still attractive when seen on a relative basis with most other geographies, they say.

Market experts attribute this trend to the gains posted by the Indian benchmark indices in the last few months even though the market has seen trade in a narrow range in the recent past. The return on equity in the Indian market is still attractive when seen on a relative basis with most other geographies, they say.

?Indian markets, already up 14% in rupee and 8.5% in dollar terms, make it the best performing large Asian market,? said CLSA, in a note on Wednesday, adding that despite the continued downward earnings momentum, MSCI India has moved up by 5% over the last one month on increasing probability of further global monetary easing.

This is further corroborated by the fact that India has seen the highest share of FII flows among leading Asian econo-mies in the current calendar year. Only South Korea with an FII flow of $10.52 billion comes close to that of India. Foreign flows into Japan are pegged at $3.61 billion in CY12, while Thailand and Philippines have seen FIIs pour in a little over $2 billion each.

In CY12, FII inflows peaked in the month of February, when the net inflows was pegged at more than $5 billion. While they invested more than $1.5 billion in March, there was a visible slowdown in April and May when FIIs reported a net outflow of $103 million and $273 million, respectively.

July saw a revival in the flows with foreign investors putting in over $2 billion in the Indian equity market.

According to a recent report by BNP Paribas, foreign investors are buying into India even though they have taken a cautious stand on the county. ?We estimate that both Asia ex-Japan and GEM (global emerging market) funds have gone overweight India by 0.5-1%. We believe that?s because of India?s relative earnings stability. Over past one to two quarters, Indian earnings estimates have remained stable while those for large Asian peers have declined 7-10%,? says the report.

According to EPFR, a global fund tracker, the start of August saw emerging markets equity funds post their biggest inflows since mid-February.