As debt funds have outperformed their benchmark, risk-averse investors can look at fixed maturity & short-term plans for higher post-tax returns

With volatility in the stock markets, risk-averse investors are preferring close-ended debt funds, like fixed maturity plans (FMPs) and short-term debts, because of higher returns and the double-indexation benefit that the plans offer. Higher interest rates have helped investors who parked their money in these debt funds and the investment potential of FMPs and short-term debts remain strong.

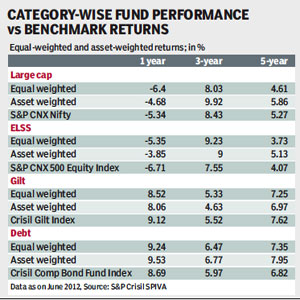

The asset weighted returns of debt funds were higher than the equal-weighted returns across 1-year, 3-year and even 5-year period. A report by S&P Crisil SPIVA says debt funds even outperformed its benchmark index (Crisil Composite Bond Fund Index) on both equal-weighted returns and asset-weighted returns across the analysed time frame. S&P Indices Versus Active (SPIVA) measures the performance of actively managed funds against their relevant S&P index benchmarks. ?A majority of the debt funds have dynamically managed their duration in response to the changing interest rates scenario. Typically, funds outperform if they lower their portfolio maturity when interest rates rise and vice-versa,? says the report.

The asset weighted returns of debt funds were higher than the equal-weighted returns across 1-year, 3-year and even 5-year period. A report by S&P Crisil SPIVA says debt funds even outperformed its benchmark index (Crisil Composite Bond Fund Index) on both equal-weighted returns and asset-weighted returns across the analysed time frame. S&P Indices Versus Active (SPIVA) measures the performance of actively managed funds against their relevant S&P index benchmarks. ?A majority of the debt funds have dynamically managed their duration in response to the changing interest rates scenario. Typically, funds outperform if they lower their portfolio maturity when interest rates rise and vice-versa,? says the report.

On the other hand, the analysis shows that a majority of large-cap equity funds failed to beat the S&P CNX Nifty, the leading benchmark index for large-cap companies listed on the National Stock Exchange. About 53% of the large-cap funds underperformed their benchmark over the last five years, 57% over the last three years and a 53% over the last year. Similarly, in equity-linked savings scheme (ELSS) the percentage of funds outperforming the benchmark in both the one and three-year period is stable at about 70%, but drops significantly to 44.83% in the five-year period. ?Of the different fund categories, the survivorship has been the lowest when it comes to diversified equity funds across categories and time. Whereas balanced funds, hybrid funds, gilt funds and debt funds had a 100% survivorship in the one-year period,? says Crisil Research’s funds and fixed income director Jiju Vidyadharan.

Fixed maturity plans

The main investment objective of an FMP is to generate returns and protect the capital invested as the schemes invest in debt products with a fixed maturity. FMPs score better than bank deposits because of their tax efficiency. In the short-term, FMPs score better as the dividend distribution tax is applicable at 14.16% and in the long-term as they have the benefit of indexation.

Most mutual funds come out with a spate of FMPs in March with a 12-month lock-in period because of the benefits of double indexation for those who stay invested for over a year. For example, a 13-month FMP launched in February 2012 will mature in March 2013. Since it will pass through two financial years, it will have benefit of double indexation. Since interest rates are still high, analysts say it is better to lock-in funds at the current rates.

Being a debt product FMPs have very negligible interest rate risk as the schemes invest broadly in assets maturing on or before the scheme maturity. Moreover, fixed income investments offer opportunities both in a rising as well as in a declining interest rate regime and one has to maximise gains. Since mutual funds cannot provide assured returns schemes, FMPs only indicate the likely returns that the scheme will give to investors. Investors in FMPs have an option to pay tax on long-term capital gains at 10% without applying indexation, or 20% after applying indexation. One should consider investing in FMPs only if the person is willing to take some risk for tax-efficient returns. As the current short-term rates are still at higher levels, investing in FMPs make sense for higher returns. Also, for risk-averse investors, investing in FMPs makes more sense as post tax, the returns are more than bank deposits.

Gilt funds

Gilt funds are also an important part of asset allocation as they have inverse correlation to stocks and could contribute significantly to the yield enhancement of a portfolio. In fact, in the quarter ended June, gilt funds gave superior returns outperforming both equity and debt-oriented funds on the back of softening of yields as the Reserve Bank of India (RBI) reduced the repo rate by 50 basis points in its annual Monetary Policy for 2012-13 in April. Bond yields and prices move in opposite directions, which means when yields fall, prices or net asset values (NAVs) of bond funds rise and vice versa.

Gilt funds that invest in government securities (G-secs) could be a good investment as the credit risk is next to nil as the government has zero risk of defaulting. But the interest rate risk rises as the market price of debt security varies with fluctuating interest rates. G-secs with higher maturity are more interest rate sensitive and investors have to look for the tenor in which the fund house is investing their money. Gilt funds are not as liquid as other funds as G-secs are not actively traded.

Analysts also say gilt funds become a good investment option when inflation is near its peak and the RBI is not likely to raise interest rates in the near future. Since interest rates have peaked, it is a good time to consider investing in gilt funds now with a horizon of staying in the fund for at least two years.