The government may use the findings of a Crisil report to counter the Comptroller and Auditor General?s (CAG) estimates on ?windfall gains? that allegedly accrued to a clutch of private companies from 57 coal blocks allocated to them between 2004 and 2009 without auction.

Coal ministry sources have hinted that the ministry may put up the report before Parliament’s Public Accounts Committee (PAC) to buttress its position that the CAG was wrong in putting the loss to the exchequer due to discretionary allocation of coal blocks at a whopping R1.86 lakh crore. ?Though the Crisil report is on methodology to calculate value of coal assets for auction, it can be placed before the PAC to prove our point. A final decision, though, is yet to be taken,? a senior coal ministry told FE on condition of anonymity.

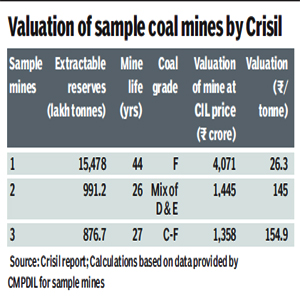

The report, which was commissioned to the private consultant by the coal ministry to evolve a methodology to work out floor and reserve prices for auction of captive coal blocks, has put the valuation of coal reserves in sample mines much lower than the benchmark figure used by the national auditor to arrive at its loss figure.

The report, which was commissioned to the private consultant by the coal ministry to evolve a methodology to work out floor and reserve prices for auction of captive coal blocks, has put the valuation of coal reserves in sample mines much lower than the benchmark figure used by the national auditor to arrive at its loss figure.

For example, for D-F grade coal, which accounts for the bulk of India?s reserves, Crisil has put the valuation at Rs 26.30-154.90 a tonne for three opencast sample mines. As against this, the CAG used a standard net gain figure of Rs 295 a tonne to calculate windfall gains to private companies. Data was provided to the consultant by the Central Mine Planning and Design Institute (CMPDIL), a consultancy firm under the coal ministry?s administrative control.

The Crisil report says that how much coal can be finally extracted from a mine would depend on the mine?s technical parameters and not the geological reserves.

According to Crisil, the report has taken cognizance of methods used in resource-rich countries like Australia, South Africa, Canada and the US to value coal assets.

Following the indictment by the CAG of the first come, first served procedure for allocation of captive coal blocks, the coal ministry has decided to switch over to the auction route. It has already identified 54 blocks with total geological reserves of 18.22 billion tonnes of coal for allocation through the auction route.

The Crisil report says that it surveyed mining practices of key coal resource countries across the world and it found that mineral resources are mostly offered for exploitation to companies on the first come, first served basis and not through auction (the only exception being Queensland in Australia where the government mandated in January 2012 cash-based bidding for exploration in areas classified as highly prospective. But detailed methodology is yet to be finalised). The valuation reports prepared by consultants are mostly referred to for private transactions or at the time of listing on a stock exchange.