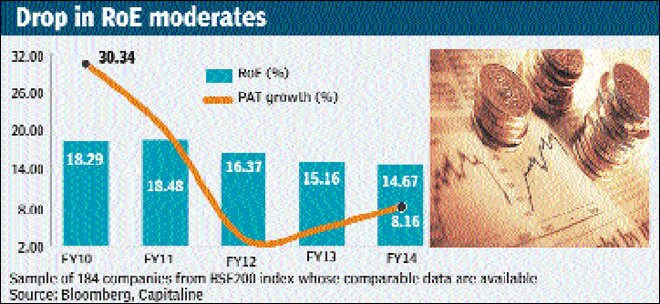

While the return on equity (RoE) generated by Indian companies for its common shareholders has deteriorated since FY11, the pace of decline has moderated in the last couple of years, signalling a bottoming out of RoE decline.

An analysis of 184 companies from the BSE 200 universe reveals that the drop in RoE has narrowed down from 2.11 percentage points (ppt) in FY12 to 0.49 ppt in FY14. The gauge, which measures how well firms invest shareholder funds, stood at 14.67% in FY14.

While the turnaround by the country?s blue chips in FY14 has helped boost shareholder returns, the deteriorating fundamentals in the core sector has limited further improvement in RoE. The combined net profit for these 184 firms grew at 8% in 2013-14 compared to 5 % in FY13. This has been aided by the return to profit by some of the bluechip firms.

For instance, India?s largest steelmaker by production, Tata Steel, returned to profit in FY14 on reviving demand in Europe, after a record loss of Rs 7,058 crore in FY13. Similarly, Essar Oil made a net profit of Rs 126 crore against a loss of Rs 1,180 crore in the previous year.

Adani Power’s net loss, on the other hand, significantly reduced to Rs 291 crore in FY14, the lowest in three years.

?EPS growth for the Sensex firms was 10% in FY14 and is likely to be around 15% in FY15, suggesting that the worst is behind us and that the cycle is turning,? said Saurabh Mukherjea, CEO, institutional equities, Ambit Capital.

A 9.4% fall in the value of rupee against the US dollar in FY14 has boosted the RoE of export-driven companies as well. Companies that reported a surge in shareholders? return in 2013-14 include pharma firms such as Aurobindo Pharma 37% (up 25 ppt), Torrent Pharmaceuticals 40% (up 7 ppt) and Lupin 30% (up 2 ppt), and tech firms, such as TCS 44% (up 3ppt), Hexaware Technologies 32% (up 2 ppt), Tech Mahindra 38% (up 11 ppt) and Vakrangee 27% (up 5 ppt).

Vakrangee, in fact, has seen a consistent rise in RoE over the last five years. FMCG major Hindustan Unilever and auto ancillaries firms Motherson Sumi Systems and Apollo Tyres have also generated decent returns during the same period.

The erosion in RoE is prominent in capital-intensive sectors, where the companies shied away from making fresh investments and a weak demand environment due to a slowdown in the economy resulted in a decline in order flows, thereby slowing bottom-line growth. Analysts observe that maintaining high levels of cash reserves on the books also impacts RoE.

For instance, refinery major Reliance Industries, which has a cash & cash equivalents of R68,568 crore at the end of March 2014 reported a RoE of 11.8%, a 7 ppt fall from FY10. ?A combination of Reliance?s cash hoard and shrinking profit margins has driven its ROE below 12%, a 15-year low? Rising profitability of its core as well as non-core business will drive consolidated RoE to 17.2% by FY17, when

the key downstream projects come onstream,? said CLSA in a recent note.

?Going forward, the RoEs in FY15 should improve marginally vis-a-vis FY14,? Mukherjea said.