Positives priced in, earnings strong but below estimates

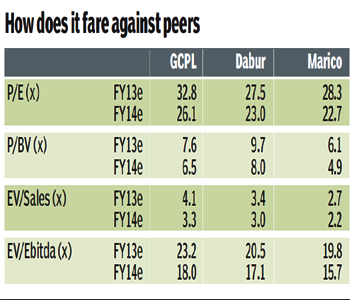

We maintain Neutral on Godrej Consumer Products with a target price of R722 as valuations reflect positives, post-strong performance in CY12. However, we lower our earnings estimate by 2% to incorporate the Ebitda (earnings before interest, taxes, depreciation, and amortisation) miss for the September quarter. The stock trades at 32.8x(times)FY13 EPS (earnings per share) of R22 and 26x FY14 EPS of R27.8.

We note Godrej Consumer’s sustained share gains in HI (household insecticides) in India and the continued robust performance in Indonesia (45% of international business). Decline in PFAD (palm fatty acid distillate? a raw material in soaps) prices can provide tailwind benefits in H2.

Positive on HI business

Godrej Consumer’s continued market share gains in HI category led by distribution synergies between Godrej consumer and Godrej household products, and the accelerated investments behind marketing and innovative products. However, we believe most of the low hanging fruits have been plucked and thus incremental share gains will be gradual. We believe the decline in PFAD prices augurs well for H2 gross margins. However, it raises the risk of higher competitive intensity from unbranded and regional players.

Godrej Consumer’s continued market share gains in HI category led by distribution synergies between Godrej consumer and Godrej household products, and the accelerated investments behind marketing and innovative products. However, we believe most of the low hanging fruits have been plucked and thus incremental share gains will be gradual. We believe the decline in PFAD prices augurs well for H2 gross margins. However, it raises the risk of higher competitive intensity from unbranded and regional players.

Q2FY13 earnings

estimate of R16.2 bn), led by 24% organic sales growth and rest by acquisitions (Darling, Cosmetica). Organic growth was driven by domestic HI business, toilet soaps and Megasari (Indonesian arm), which posted a strong 20%, 24% and 37% revenue growth, respectively.

Gross margins expanded 30 basis points y-o-y to 51.9%, while consolidated Ebitda margins declined 210 basis points y-o-y at 15.3%, mainly due to a 150 basis points increase in staff costs. Higher staff cost is due to Darling and Cosmetica acquisitions, where employee expenses are higher vis-?-vis other geographies. Consolidated Ebitda grew 18% to R2.44 bn while net profit increased 25% due to higher other income and lower tax rates. Company booked MTM (marked-to-market) forex losses of R76m on a consolidated basis and a gain of R8m on standalone entity.

Indian business (56% of consolidated sales)

India business reported sales of R9.2 bn, up 19% y-o-y. Gross profit at R4.4 bn increased 19%. Ebitda margins declined 120 basis points y-o-y at 16.3% led by higher adspends. Adjusted profit increased 17% on account of R8m forex gain (R85m loss in base) and 150 basis points lower tax rate, despite a steep increase in interest cost from R26m to R47m.

HI maintained strong growth, with sales up 20% y-o-y, far ahead (1.5x) of category growth rates. As per industry data, Godrej Consumer has gained 310 basis points market share in HI year-to-date till August.

Toilet soap sales grew a healthy 24% y-o-y, with 6% volume growth, down from 19% in Q1. According to management, the volume growth should revive after Q3 as it has recently relaunched Cinthol with a youth-centric positioning. Company has gained 40 basis points market share in soaps in YTD (year to date) in CY12, even as the category posted 20%-plus growth.

Hair colour performance remained muted with 10% sales growth. During the quarter, Godrej Consumer entered into Cr?me Hair Colour format under Expert brand. Management, during the conference call, indicated strong response to this launch with demand far exceeding supply in the initial stages. Hair colour has remained a sore point for Godrej Consumer due to lack of presence in the premium segment, which is growing significantly higher than the powder portfolio.

International business (44% of consolidated sales)

Godrej Consumer’s international sales expanded 63% to R6.8 bn, driven by 32% organic growth, which in turn was aided by currency depreciation. Ebitda grew 33% and margins declined 300 bps to 12.9% driven by a sharp fall in Africa margins. Megasari sales grew 37% y-o-y (constant currency growth of 26%) to R3.2 bn and Ebitda margins stood at 19%. Hit Magic Paper continued to do well and grabbed 8% market share. Godrej Consumer launched HIT one-push aerosol during the quarter. Africa (24% of international sales, includes Rapidol, Kinky, Tura and Darling Group) reported sales of R1.63 bn and Ebitda of R261m (R274m in Q1FY13), with Ebitda margins of 4%.

Latin America sales (19% of international) grew 93% y-o-y to R1.27 bn led by new product launches and Chile business consolidation. Ebitda margins declined sharply to 4% due to higher brand spends for new launches. It launched various personal care products under Villeneuve and Pamela Grant brands.

Motilal Oswal