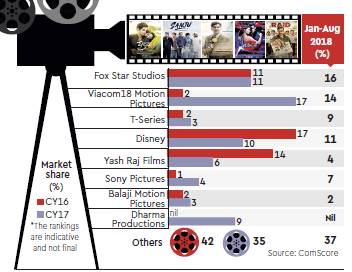

A slew of releases in the past three years — from Neerja, Judwaa 2, Baaghi 2, Jolly LLB 2 to the recently released Sanju — has helped Fox Star Studios gain market share in the film production business. Between January and August this year, Fox Star Studios — a joint venture between the US-based 21st Century Fox and Star India — has cornered a 16% market share, reveals data from ComScore; its share in CY2017 was 11%. T-Series is another gainer with a share of 9%, while Viacom18 Motion Picture has given up some share.

Local box office collections, according to FICCI EY, were around Rs 9,600 crore in 2017 and should grow to Rs 10, 300 crore in 2018. Vijay Singh, CEO, Fox Star Studios, says the focus is to create two kinds of films — tentpole or franchise-based films such as Baaghi 2, Jolly LLB 2 and high quality concept films that are able to draw audiences to the theatres. Apart from producing its own films, the company has inked several strategic alliances with other productions firms.

For example, Fox Star Studios has a nine-film deal with Karan Johar’s Dharma Productions and a three-film deal with Rajkumar Hirani and Vidu Vinod Chopra. Sanju was the first of the three films to be released and earned Rs 344 crore at the domestic box office. In 2018, Fox Star will release, among others, Total Dhamaal, Zoya Factor, Drive and Kalank.

Apoorva Mehta, CEO, Dharma Productions, says it is important to come up with good ideas. “In a situation where the movie window has shortened, I would rather offer better content that moves viewers and brings them the theatres for a first day first show experience,” he adds.

Dharma Productions posted a 94% increase in net profit to Rs 31 crore in FY17 against Rs 16 crore in FY16. Its revenues grew 69% to Rs 430 crore in FY17, compared to Rs 255 crore in FY16, as per regulatory filings by fetched by Paper.vc. Its big release Bahubali 2 clocked Rs 510 crore at the box office in 2017.

Industry watchers point out that movie studios are currently betting their money on three genres. The first is the visual spectacle like Bahubali or action films with big stars, the second genre is franchisee-based films such as Golmaal and Housefull and the third comprises medium-budget films with differentiated content such as Hindi Medium and Sonu Ke Titu Ki Sweety. Sneha Rajani, head, Sony Motion Pictures, explains that the mid-budget films provide a better return on investments.

According to industry estimates, typically, the cost of producing a medium-budget film such as Hindi Medium or Qarib Qarib Single ranges between Rs 25 crore and Rs 35 crore, while the cost of production of films such as Race 3 featuring Salman Khan is about Rs 100 crore. A period drama such as Padmaavat would see the cost of production increasing to as much as Rs 215 crore.

Sunil Lulla, Group CEO, Balaji Telefilms, says it is easier to drive a higher return on a small size investment than on a large investment. “Returns are also a function of how the rights maybe structured, and what’s pre-sold and who controls box office. The risk is higher as the investment goes up since it is expected then that audiences will flock to the theatres,” he adds.

Lulla, however, points out that despite the scale of production, the return expectations are the same. “So, if a movie made 10% of capital employed with Rs 10 crore as capital employed or 10% on Rs 100 crore employed, the value is only in scale because the return on investments is the same. Movies are made with multiple investment partners with different degrees and levels of payout,” he says.

For Ashish Pherwani, leader, media and entertainment, EY, the strategy followed by film production firms is to de-risk themselves by investing in movies which are different in cost and cast, as there is no formula of success.The film industry is expected to clock of Rs 16,570 crore in 2018; up 6.5% over 2017, according to forecasts by Ficci. That’s a slower pace of growth than the 27% in 2017 when revenues were Rs 15,550 crore.

For Bhushan Kumar, chairman and MD, T-Series, in the past year-and-half, the company has been producing a lot more films. “Initially, we were testing waters with film production but the critical and commercial success of our films Hindi Medium and Tumhari Sulu boosted our confidence. We realized that we needed to invest in content driven films,” he observed.