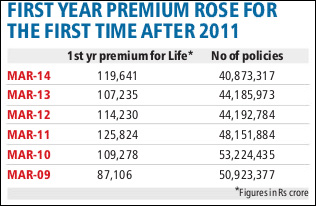

After witnessing decline for two consecutive years, FY14 saw some pick up in the first year premium collection in the life insurance space, thereby suggesting some growth coming back to the industry. While the industry is still some distance away from the premium collection figures it clocked in the year ended March 2011, since when the decline began, there is a lot the industry will need to do to reach out and to sustain its growth.

The Reserve Bank of India has decided to roll out banking licences on a regular basis with an aim to reach out to the unbanked and enhance banking coverage. Even the Securities and Exchange Board of India has allowed individuals without PAN card or a bank account to invest up to Rs 50,000 in mutual funds through cash and allowed special incentive for selling mutual funds beyond top 15 cities. On the same lines, the insurance industry will also have to take steps that push the reach and growth of the industry that has languished over the last few years.

Issues crippling the industry

The state of the broader economy has certainly a lot to do with the performance of the financial services sector. Over the last few years, a decline in GDP growth rate and high inflation have had a direct impact on the disposable income of individuals and had an impact on the money flowing into insurance sector along with others.

A stagnant equity market has also played a role in the investors? disorientation from equity-oriented schemes as they moved towards gold and real estate. Unit-linked insurance products have suffered hugely and their volumes have gone down significantly. However. a strong mandate provided by the electorate in the recently concluded general elections does augur well for the equity markets and the overall financial sector.

The industry has been suffering from low penetration which currently stands below 5 per cent of the GDP and also has been affected by low level of awareness on need for protection cover.

?The moderation in the net financial saving rate of the household sector during the past couple of years mainly reflected an absolute decline in small savings and slower growth in households? holdings of bank deposits, currency as well as life insurance funds. Households seemed to have favoured investment in physical assets like real estate and valuables, such as gold,? said Rajesh Sud, CEO & MD, Max Life Insurance.

While misselling has been another menace that has taken a hit on the credibility of the sector, complexity of the products designed by product manufacturers has only added to their woes.

What the industry needs

The list is long. While a strong electoral mandate is something that would have been on top of mind of all insurers, it is something that has already been delivered by the Indian voters and has also led to a rise in investor sentiment as the Sensex at the Bombay Stock Exchange is trading at a new high and even breached the 25,000 mark on May 16.

The industry has also been looking for an increase in foreign direct investment limit from 26 per cent to 49 per cent. While the industry certainly needs capital for the overall business growth, the move will not only help it get the required capital but will also benefit the existing investors in the companies. A higher capital may also attract bigger global players in the Indian insurance industry and thereby will prove to be beneficial for the Indian consumers.

While increasing penetration is a major challenge for the industry, experts say that allowing banks to operate as licensed insurance brokers and sell products of multiple life insurance companies is the need of the hour.

?This will lead to an open bancassurance architecture and drive banks to align their interest with their customers by offering them a wider choice of products from a larger number of life companies, instead of the existing conflicted practice of pushing products from a single manufacturer,? said Anup Rau, CEO, Reliance Life Insurance. He added that it will provide easy access to all customers, bring a level playing field for players and also reduce the distribution cost. ?In principle banks should represent the customer and not the manufacturer,? said Rau.

Tax incentive on life insurance premiums have been another prominent demand from the investors as they feel that long-term savings in the form of insurance can be best promoted by providing tax incentive on such products.

?The effectiveness of tax policies is clear with regard to shifting national savings to life insurance and promoting long-term savings. An additional tax incentive of Rs 1.5 lakh to life insurance and Rs. 1 lakh for retirement plans could result in significant growth in life insurance industry which will also result in additional inflow of Rs 90,000 crore in infrastructure and Rs 2,20,000 crore into government securities by Financial Year 2020,? said Sud.

Recently, IRDA came out with a draft for setting up Insurance Marketing Firms (IMF) in a bid to increase life insurance penetration in the country. They will work like the independent financial advisors and offer integrated financial solutions under one roof. While it is expected to promote entrepreneurial drive they could also help financial services industry tackle the problem of high attrition of distribution intermediaries. While it is a work in progress, it needs to be seen how it shapes up for the sector.

What can the industry do

While there is a lot that is demanded from the government and the regulators, industry insiders say that there is lot that even the insurers can do themselves.

?I do not think the industry has acted responsibly in the past. There have been complex products that have been there in the market which the investors don?t understand and have been mis-sold. The least that the industry can do is to come out with simple products,? said Rau.

There is a need to revive the Ulips and experts say that the industry can help itself by encouraging customers to buy the product for the long term as currently the lapsation rates are high. The charge structure needs to be revised in a manner that they encourage distributors to retain the customer for the long term.

The markets have risen and investor sentiments are on rise. It may be wise for the industry and the regulators to chart out a plan to target consumers in good faith and go for mobilizing long term savings that may contribute to the growth of the economy.