The scrip of state-owned oil explorer ONGC led the rally in upstream oil companies on Friday, buoyed by news report that the government is likely to finally notify the gas pricing formula suggested by the Rangrajan committee in December 2012.

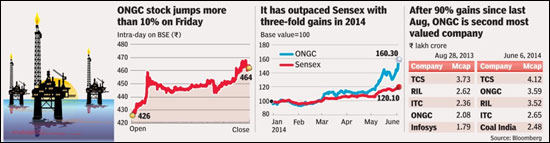

On hopes that the petroleum ministry may go to the Cabinet for asking to approve the recommended hike in gas prices from the current $4.2 per mmBtu to $8.5-9 ? the key recommendation of the Rangarajan Committee ? the ONGC stock soared 10.6% to R464, a record closing high even as the Reliance Industries and Cairn India scrips gained 2.97% and 2.31%, respectively.

Ever since the Street started factoring in a change of guard at the Centre, the ONGC counter has witnessed strong buying interest. Analysts have been betting on a revival in the energy sector as the Narendra Modi government is expected to be proactive and remove supply-side bottlenecks. The stock rallied as much as 60% in 2014, outpacing the benchmark Sensex that has gained about 20% in the year so far. Equally remarkable is the fact that ONGC is now the second most valued Indian company with a market cap of R3.96 lakh crore, a tad lower than R4.08 lakh crore of market value of Tata Consultancy Services (TCS).

Analyst estimates suggest that the proposed gas price hike could add about R9-11 to the earnings per share (EPS) of ONGC.

As per Kotak Institutional equities, as the government undertakes policy reforms to improve India’s fiscal situation and energy security, earnings of ONGC is likely to benefit from higher gas prices and lower fuel subsidies. After factoring in risk of lower realisation from the power sector, the brokerage expects ONGC to report EPS y-o-y growth of 16.7% (R36.4) and 13.5% (R41.3) in FY15 and FY16, respectively.