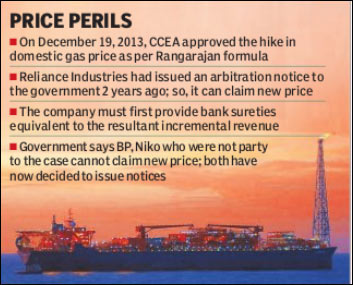

The proposed increase in natural gas prices from early next month would be available only to Mukesh Ambani’sReliance Industries (RIL) and not to its partners, BP Plc of UK and Niko Resources of Canada.

The proposal, already mired in controversies due to litigations and corruption charge against petroleum minister M Veerappa Moily, says that only RIL be allowed to sell KG-D6 gas at the revised price of nearly $8.4 per mBtu from April 1, while its two partners would continue to get current price of $4.2 per mBtu.

The proposal, sent to Moily on Thursday, has also suggested that BP and Niko?s share of the increased prices be kept in gas pool account, or an account identified by the department of expenditure, until an ongoing arbitration with RIL was settled.

KG-D6 gas was allowed quarterly increase in gas producer prices after the Cabinet Committee on Economic Affairs (CCEA) last December decided that RIL provide a bank guarantee equivalent to the incremental revenue the contractor – that is all three — would get from the new rates covering the price increase.

This scheme was to continue until RIL?s arbitration case against the government for levying penalties for KG-D6 production shortfall was settled. RIL had dragged the ministry to arbitration last year, saying the contract did not provide for levy of a $1.8 billion penalty for output not being in line with projected production profile.

It says the decline in current output to a 10th of the previously projected 80 million standard cubic meters per day was purely because of unanticipated geological complexities such as a drop in reservoir pressure and ingress of water and sand.

Sources said RIL declined to provide bank guarantee on behalf of its partners saying that it could guarantee only for 60 per cent of the price increment as it held 60 per cent share in the block and was entitled to the same percentage of profit gas. BP holds 30 per cent equity while Niko holds 10 per cent in the KG-D6 field.

Faced with this dilemma, the ministry officials proposed on Thursday that since block operator RIL was not providing bank guarantee for BP and Niko?s share of extra revenue, the two could not be given the raised price and their share be kept in government-controlled accounts.

And, in case the two partners decide to file a petition against the penalties, the ministry gave the option that they be given the increased gas price provided they furnish bank guarantee against their share of extra revenue.

Indian Express Power List: Mukesh Ambani at no 19

The ministry has also proposed that KG-D6 gas buyers, mainly state-run fertiliser companies, be directed to deposit the separate funds directly into the RIL account and a government-nominated account.

If it is proved that RIL deliberately produced less gas from KG-D6, the bank guarantee will be encashed depriving RIL of the incremental revenue.

BP and Niko, which have maintained that they are party to the arbitration and RIL has represented them as an operator representing the interests of all the KG-D6 constituents, are likely to file separate arbitration notice.

RIL KG-D6 output drops again

After two months of increase, gas production from Reliance Industries? KG-D6 block has again started to drop. Output has dropped to 13.28 mmscmd in March, the DGH said in a report to the oil ministry.

Also check: