With high level of borrowings and fears of a rating downgrade, there seems to be no respite in sight for the bleeding oil marketing companies such as IOC, HPCL and BPCL till January.

According to sources, the finance ministry is not likely to release any compensation to OMCs for their under-recoveries incurred on account of selling fuel products below market price before the beginning of next year.

?The money will have to come from the finance ministry when the supplementary grant comes in the month of January. Till that time OMCs are on their own,? a senior oil ministry official said requesting anonymity.

A finance ministry official also confirmed that this year’s compensation to oil companies could only be met after the approval of expenditure through the suplementaries as almost 90% of subsidy provided in this year’s budget has been exhausted.

A finance ministry official also confirmed that this year’s compensation to oil companies could only be met after the approval of expenditure through the suplementaries as almost 90% of subsidy provided in this year’s budget has been exhausted.

The oil ministry is likely to seek subsidy of over R1 lakh crore in current financial year, an amount that has also been indicated by new petroleum and natural gas minister M Veerappa Moily. The oil ministry is already in talks with the finance ministry for an early release of the cash subsidy to give respite to the bleeding finances of oil marketing conmpanies. Moily has reportedly said that finance ministry could issue subsidy letter for first two quarters this week that would help oil companies to make adjustments in their book of accounts to show lower levels of losses from selling cooking gas, kerosene and diesel below the market price.

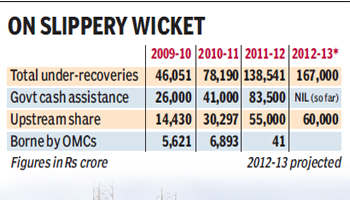

?About R60,000 crore of under-recoveries in the current year are likely to be borne by the upstream companies (ONGC, OIL and GAIL). Efforts will be made to persuade the ministry of finance to compensate the balance under-recoveries,? Moily said earlier.

Oil marketing companies are currently losing close to R10 per litre on sale of diesel and R34 per litre on sale of kerosene. The revenue loss in case of cooking gas is about R470 per cylinder. The total underreciveries for oil companies in first two quarters is expected to be around R85,000 crore of which it has got R15,000 crore from upstream oil companies such as ONGC, OIL and GAIL for the first quarter period.

With the finance ministry quiet on the requisite budgetary support, oil marketing companies (OMCs) are fearing rating downgrade. Borrowings of the government-owned entities are poised to touch record highs this fiscal.

The rating agencies have lowered the rating outlook of OMCs but the rating has not been downgraded. A cut in ratings could raise their borrowing costs, especially for foreign funds. Indian corporates are tapping overseas debt market after the government slashed a tax on foreign borrowing.

OMCs’ combined borrowings have already reached R1,60,000 crore compared with last year?s R1,65,000 crore. The deteriorating liquidity condition has forced them to borrow from market at high interest cost to meet their working capital requirements and capital expenditure.

A senior government official said the finance minister has questioned the under-recovery calculations by the OMCs. The issue was raised in August for the first time and again at a recent meeting with financial advisers of the ministries.

Between July 2011 and October 2012, the Indian currency has devalued against the US dollar by 16.34%, adding depreciation of rupee by one against the US dollar results in a burden of R9,000 crore annually.

The finance ministry is quiet on the release of compensation and has questioned the calculations for the losses they incur. The under recovery for the current fiscal was estimated to be R1,80,000 crore before the diesel price hike. After the hike, the under-recovery is at R1,67,000 crore.