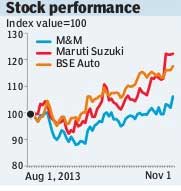

Given the weak demand environment, expectations for the quarter were low, but Maruti Suzuki India (MSIL) posted an impressive beat on localisation gains and higher share of exports. We remain OW (overweight) and expect FY14 to see margin expansion and FY15 to see earnings growth driven by the model cycle.

Q2 results: Maruti reported top-line Ebitda and profit after tax growth of 26%, 160% and 195% year-on-year, respectively. Ebitda was 27% ahead of our estimate. Comparison on y-o-y basis is distorted, as Q1FY14 numbers include SPIL (Suzuki Powertrain India Ltd), plus the company had a strike in Q2FY13).

We increase our net income estimates by 25% in FY14 and by 11% in FY15. Most of our upgrade is coming from Q2 beat, where we saw first signs of localisation gains and stronger INR.

* Volumes and discount assumptions largely unchanged: We expect flat volume growth over FY14/15. In FY15, we expect 10% volume growth in the domestic market and 8% growth in exports. Rural represented 31% of sales in Q2FY14 and grew by 24% y-o-y, and this will likely be a key driver for FY15 volumes. Most of our growth assumptions stem from better rural growth, as the urban demand recovery will be slow.

n Build better export profitability and cost rationalisation gains: In a bid to reduce currency volatility, the company targets to reduce raw material-linked forex exposure from 20% of net sales at end-FY13 to 16.5-17% at end-FY14 and to 14-15% by end-FY15. Localisation also leads to cost savings, and we saw early gains from that in Q2 results.

n Currency has appreciated: On our estimates, every 1% INR appreciation against JPY (yen) leads to a 2% earnings increase for MSIL, thus its currency sensitivity is high. For F14, we factor in USD /INR of 61.5 and USD/JPY of 97, closer to spot. Benefitting from both favourable currency and cost savings from localisation, Ebitda margins will improve to 12.4% in FY15 .

* Our price target rises to R1,786: This largely reflects our earnings upgrade and a reduction in our bear case probability weighting, as INR has stabilised. At our price target, F15e P/E would be 15.2x.

New model news flow could re-rate the name: In a slow year(s), it is tough to base a call on industry recovery, so new model cycle becomes paramount. Our

channel checks indicate that MSIL is working on a new car in early 2014 and an SUV/crossover in F15. Any confirmation on new launches would likely lend high visibility to volumes and support a re-rating.

– Morgan Stanley