More steel companies went under lenders? corporate debt restructuring (CDR) in fiscal 2012 as higher raw material cost and lower demand crippled their ability to repay loans. CDR is a mechanism evolved by the Reserve Bank of India to help companies that are unable to repay loans from multiple institutions with their cash flows. Lenders extend loan repayment schedule, giving a moratorium to companies.

The total debt of iron and steel makers under CDR rose 7% to R39,252 crore until March 2012 from R36,673 crore in March 2011. The sector accounts for 26% of the total debt under CDR until March 2012, with 31 companies under CDR. Visa Steel, promoted by Vishambhar Saran, who worked with Tata Steel for 25 years, got its CDR scheme approved in June. Ruchi Power & Steel, Maithan Ispat, Rim Jhim Stainless Steel, and Mackeil Ispat & Forgings are others under CDR.

The total debt of iron and steel makers under CDR rose 7% to R39,252 crore until March 2012 from R36,673 crore in March 2011. The sector accounts for 26% of the total debt under CDR until March 2012, with 31 companies under CDR. Visa Steel, promoted by Vishambhar Saran, who worked with Tata Steel for 25 years, got its CDR scheme approved in June. Ruchi Power & Steel, Maithan Ispat, Rim Jhim Stainless Steel, and Mackeil Ispat & Forgings are others under CDR.

A steep rise in raw materials like iron ore and coking coal hit mid-sized steel makers? production cost as it had to depend on imports. Roughly 2,000 pending proposals with government to develop mines, factories, ports, roads and bridges also hit the steel sector.

?Smaller steel companies do not have captive iron ore mines despite applying for mining leases as their applications wait for environmental clearance,? said Ritesh Shah of Espirito Santo Securities. ?Raw material costs have put pressure on their margins making it difficult for them to service debt.?

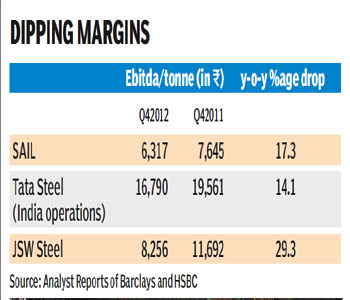

Large steel makers? profit margins from every tonne of steel sold are also hit. Profit margins of India?s three biggest steel companies Steel Authority of India (SAIL), Tata Steel and JSW Steel have fallen anywhere between 15% and 30% in fiscal 2012 fourth quarter as they paid more for raw materials. The three companies produce more than half of India?s steel.

?Coal import costs have gone up,? HM Nerurkar, managing director of Tata Steel, said after announcing fiscal fourth quarter results on May 18. ?Production and sales are moving up as per plan, but going forward if the economy doesn?t improve the margins will be hit.? The BSE Metal Index fell 30.83% compared with the BSE Sensex which fell 8.76% in the past one year.

The government in three years from 2009 cleared only 549 projects with 1,987 projects pending for environmental clearance. Mining proposals account more than a quarter of these projects including coking coal mines cutting down domestic production. India, which produced 23 million tonnes of cooking coal in 2008, is estimated to produce only 21.7 million tonnes in 2013, according to coal ministry estimates, which India steel production has grown from 58.4 million tonnes in FY09 to 72.3 million in FY12.

Importers had to pay more as rupee fell even as global commodities prices weakened. India imports 36.8 million tonnes of coking coal.

Coking coal prices have fallen almost 38% since the second quarter of 2011 fiscal to $206 a tonne in the first quarter of fiscal 2013. But rupee has fallen to R56 a dollar from R45 a year ago. Steel makers are yet to benefit from fall in coking coal from fiscal second quarter. ?A combination of firm steel prices and lower coking coal cost will help steel margins. In FY13, we see Indian steel Ebitda margins higher by $10-30 per tonne compared to current estimates,? Prasad Baji and Navin Sahadeo, analyst at brokerage Edelweiss Securities India, wrote in a research note titled ?steel metals and mining sector? released on April 19.

Iron ore production also fell by 17% to 60 million tonne in the fiscal 2012 from 73 million tonne a year ago. The country is estimated to have 3,297 million tonnes of iron ore, as per the Geological Survey of India.

?Essar Steel, Bhushan Steel and JSW Ispat have imported close to a million tonnes of iron ore in the last fiscal,? said a Mumbai-based metals trader. ?Production of steel has gone up but virtually no new iron ore mine has begun operations since 2009. But I see the imports being temporary an India won?t become a net importer.?

Steel consumption, too, has slowed as economy contracted. Growth fell to 5.5% in fiscal 2012 from 9.9% in the previous fiscal, according to government data. Edelweiss Securities also expects a muted growth of 6.5% for the fiscal 2013.

Steel makers say the blip in consumption is temporary. ?India is a demand centre for steel,? said SAIL chairman CS Verma after announcing the company?s fiscal fourth quarter results on May 29.

In an earlier interaction with FE, Verma had said that there might be a demand-supply mismatch in the short-term, but Indian steel demand looks positive in the medium to long term.

?We strongly believe that the current phase is a temporary transition period and the Indian economy will do well in the long term,? said Amit Agarwal, CFO of Essar Steel. ?Indian per capita consumption of steel is one of the lowest and the potential for growth cannot be undermined.?

Until April 20, Indian iron and steel makers owe R1,92,550 crore to banks, according to data from the RBI. Lenders Banks are also becoming wary of lending to the sector. ?Credit growth to metal-intensive industries remains a concern with growth in January 2012 and February 2012 slowing to 17.5% y-o-y and 16.5% y-o-y respectively, significantly below last year,? said Baji and Sahadeo of Edelweiss Securities.