With a large number of public sector banks reporting weaker than expected asset quality, bankers agree that some credit growth may be sacrificed for better recoveries. Bank chiefs have given aggressive recovery targets to their branch managers, while lowering loan growth targets for the fiscal.

Indian Overseas Bank reported net non-performing assets (NPAs) worth R3,378 crore in the July-September quarter, which rose from R1,505 crore in the same quarter last year. M Narendra, chairman and managing director said this was because of a few major accounts which turned NPAs in the quarter.

Indian Overseas Bank reported net non-performing assets (NPAs) worth R3,378 crore in the July-September quarter, which rose from R1,505 crore in the same quarter last year. M Narendra, chairman and managing director said this was because of a few major accounts which turned NPAs in the quarter.

According to senior officials of the bank, Narendra has given an annual loan recovery target of Rs 1,450 crore to all the branch managers. The bank also revised its annual loan growth target for the fiscal to 15%, from the earlier guidance of 20%.

Union Bank of India (UBI), on other hand, will try and focus towards more productive sectors for the rest of the year, maintaining a strict look at credit quality and recovery. However, in case of credit growth, the bank said that the slowdown was more on a macroeconomic level, rather than a conscious decision by the bank.

“Year-on-year growth in advances as of this quarter, is at 19.95%. But On a conservative basis, we are projecting that we will grow credit by 17%, from earlier guidance of 18%,? said SS Mundra, the executive director.

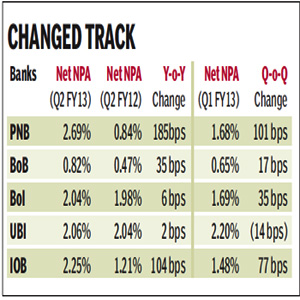

UBI’s net NPAs in the quarter rose to R3,559 crore, up 20% from a year ago. As a ratio of total assets, net NPAs stood at 2.1%, as against 2% last year.

Punjab National Bank?s net non-performing assets (NPAs) rose by 277% to R7,883.43 crore in the September quarter. As a ratio of total assets, net NPAs stood at 2.04%, as against 1.98% last year.

KR Kamath, the chairman and managing director of the bank, agreed that the bank’s main aim during the rest of the fiscal would be to increase its recovery. However, the bank’s credit growth will not be consciously slowed, he said. PNB is currently working on internal recovery targets which will be shared with branch managers over the course of the next few days.