Long-term growth story far from over, never mind near-term bumps

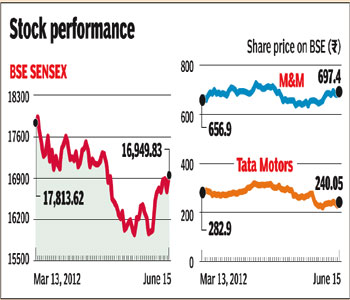

Surprise fall in Q4FY12 JLR (Jaguar Land Rover) margins and a rather soft April sales (and a likely soft May and June sales) has raised investor concerns. The earnings upgrade cycle has sure stalled, resulting in a stock correction of near 25% from the peak.

We believe the stock is likely to live through another quarter to weak profitability (Q1FY13) as sales growth remains weak. However, as the bookings for the new RR (Range Rover) commence from the end of Q2, the positive momentum of a robust product cycle will again be visible leading to earnings and stock upside.

We believe the stock is likely to live through another quarter to weak profitability (Q1FY13) as sales growth remains weak. However, as the bookings for the new RR (Range Rover) commence from the end of Q2, the positive momentum of a robust product cycle will again be visible leading to earnings and stock upside.

Q1 is likely to see weaker volumes and further fall in margins.

China may be impacted by weaker RR sales before the impending new launch: China has been one of the key growth markets for global luxury car markers, including JLR. The demand for SUVs (sports utility vehicles), particularly, has been so strong that dealers in the past have been overcharging for early deliveries. However, in the past few weeks we have seen moderation in demand growth. Our supplier checks suggest a decline in waiting periods for RR and even RR Evoque in China. The reported sales of other OEMs (original equipment manufacturers) such as BMW in April/May in China have not shown any visible signs of significant slowdown, but we believe specific to JLR till the new RR is introduced; sales growth for JLR in China may remain subdued, relative to the historic trends. Range Rover series has grown strongly at 22% year-on-year in FY12, but has slowed down meaningfully in April and May 2012.

The new Range Rover and Range Rover sports, which is widely anticipated to be launched around September of this year, if is as successful as Evoque, could lead to significant upside risks to our overall FY13 sales estimates. This should have a positive impact on margins as well due to a richer product mix. Until its launch the demand for the current Range Rover model may soften as buyers wait for the new model, which could even press JLR to increase discounts in order to clear the current batch of production.

The new Range Rover and Range Rover sports, which is widely anticipated to be launched around September of this year, if is as successful as Evoque, could lead to significant upside risks to our overall FY13 sales estimates. This should have a positive impact on margins as well due to a richer product mix. Until its launch the demand for the current Range Rover model may soften as buyers wait for the new model, which could even press JLR to increase discounts in order to clear the current batch of production.

Slowdown in Western markets may impact realisations: Most of the luxury car makers (including JLR) have reported a slowdown in growth in Western markets. On the whole, US monthly numbers for May (entire market) were below expectations. This is resulting in higher incentives for bigger cars/SUVs and customers tending towards lower end of the luxury market, impacting both realisation and margins for OEMs.

Monthly premium car sales year to date suggest a trend of down trading in the segment. Q4 saw JLR margins also getting impacted by these trends, which may continue in Q1FY13.

Operating leverage and product mix to turn favourable from H2: Capacity utilisation and resulting operating leverage may provide strong support to margins from Q3FY13. Additionally, from Q3FY13 the contribution of new RR should increase, thereby positively impacting realisations and margins.

Currency movements remain favourable: JLR derives near 50% of its sales in USD, which means depreciation of GBP to USD positively impacts JLR margins. A 1% fall in GBP/USD rate positively impacts margins by near 80 bps (30-40 bps post-hedging). Furthermore, JLR is a net importer in EUR, which means depreciation of EUR to GBP positively impacts margins. Again EUR/GBP trends have been favourable for JLR.

Overall we expect 21% growth in Ebitda in FY13. While Ebitda margin expectations have been set lower now (from 17% to 15.4% for FY13 post-Q4FY12 results), this will still result in a healthy 21% Ebitda y-o-y growth in FY13.

Lower margins and higher capex = cut in cash flow estimates: Reset of margin expectations for FY13, from 17% to 15.4% and higher capex in FY13 than earlier guided by the company will deteriorate the FCF (free cash flows) generation in FY13. FCF in FY13 will fall to near half in FY13, from FY12. However, we believe these are early years for JLR product cycle and a high capex (particularly R&D) in the early years is a necessary evil. Importantly, while the return ratios (ROCE) are falling as well, it still remains reasonably healthy from a relative basis to other luxury car makers.

While cash flow conversion (FCF to Ebitda) may deteriorate due to higher tax and capex, JLR is already a net cash positive company with a net cash/equity ratio of 0.2x which we expect to remain flat in FY13 as well. We do not envisage medium term risks associated with debt position of the company, and expect the cash flows conversion to recover in the long term.

Going gets tough for the domestic business: The domestic business has been mainly driven by the growth in the LCV (light commercial vehicles) segment in the past few months, as MHCV (medium and heavy commercial vehicles) sales continue to struggle on a relatively weak macro cues for the industry. The high interest rates, increase in excise duty, hike in petrol prices and uncertainty surrounding diesel vehicle taxes has dented sales outlook for the industry. Further the weak GDP growth of 5.3% in the most recent quarter raises concerns on investment and growth outlook of the country.

We cut our MHCV sales outlook due to sustained sales pressure in view of the current business environment and expect FY13 to see a decline of 3% y-o-y. Overall, margins for the domestic business improved strongly by near 300 bps in 4Q to 9.5%, but we expect the full year FY13 margins to be at 8.3% as the overall product mix is skewed to smaller cars/LCVs and discounts remain high in the car business.

Change in estimates and valuation: As discussed earlier, the likely increase in incentives and change in product mix will lower average realisations for the JLR business.

Accordingly we revise down our revenue estimates by 3%/2% for FY13/FY14 respectively and at the Ebitda level we cut down our margins by 180bps/260bps. Factoring in the revision of margin expectations for FY13, from 17% to 15.4% and higher capex assumption than earlier we cut down the FCF generation by near 60% for FY13.

In the domestic business we revise down our volume forecast for MHCV and cut our revenue estimates by 4%/3% for FY13/FY14.

The rupee depreciation of near 10% increased the revenue contribution from JLR offsetting the downward revision of estimates in GBP terms.

Overall we value the stock at Rs. 320. Our target price implies a PE multiple of 7x (times) our FY14 earnings.

HSBC Global Research