Real estate shares took a beating on the bourses on Tuesday, extending a week of volatility for the sector, amid increasing uncertainty surrounding RBI’s next policy move. The BSE Realty index slid a little over 3% on Tuesday, with 11 out of the 12 stocks in the index ending in the red. DLF, Unitech and HDIL led the declines. DLF, which has the most weightage in the index of over 32%, slipped 2.44% to R199.65 on the BSE.

The stock extended declines after a television report said the Delhi High Court had dismissed the realty major’s plea against a probe by the Securities and Exchange Board of India (Sebi). DLF had sought quashing of Sebi’s order for investigation into the allegations of a Delhi-based businessman against it and associate firm Sudipti Estates.

The stock extended declines after a television report said the Delhi High Court had dismissed the realty major’s plea against a probe by the Securities and Exchange Board of India (Sebi). DLF had sought quashing of Sebi’s order for investigation into the allegations of a Delhi-based businessman against it and associate firm Sudipti Estates.

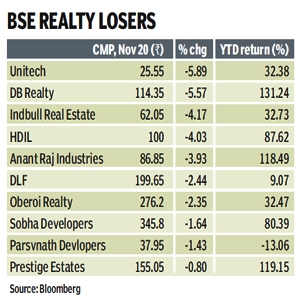

Unitech, which has a weightage of 14.11% in the realty index, slid 5.89% to R25.55 on the BSE, while HDIL with a 10.46% weightage dipped a little over 4% on the exchange. Other major losers on Tuesday were DB Realty (5.57%) and Indiabulls Real Estate (4.17%). The BSE Realty index has slid 4.4% in the past week. ?The fall was driven by uncertainty surrounding the interest rate front,? said Mridul Mehta, executive VP, ICICI Securities. Analysts are of the opinion that the RBI may maintain its status quo and hold the interest rates during its policy review in December, opting for a cut in cash reserve ratio (CRR) instead.

The RBI has cut the CRR twice during its last two policy reviews, but warded off pressure from the government and India Inc to keep key policy rates ? repo and reverse repo ? unchanged, citing inflationary concerns.

?From a fundamental standpoint there was no reason for their decline today,? said an analyst from brokerage Motilal Oswal Financial Securities. ?The benchmark indices have been falling during the past week and being a high beta sector, realty stocks have understandably been facing some pressure,? he added.

Interestingly, most realty stocks have gained significantly in the year till date ? for instance, stocks such as DB Realty, Anant Raj Industries and Prestige Estates are up more than 100%. The BSE Realty index is up 33% in the period. Realty stocks gained this year mainly on anticipation of interest rates cuts by the central bank, said experts. Parsvnath Developers is the sole realty major, which features among the losers with declines of 13% for the year.