Nine months after the first SME company got listed on the BSE, the trading activity on the SME platform of the exchange has remained muted.

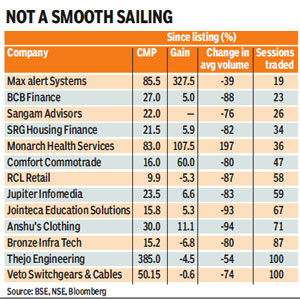

All 11 companies listed in the segment have seen a sharp decline in trading volumes; and the frequency of trading for two-thirds of these scrips was less than 70% since their respective listings. While the NSE has so far introduced two stocks on its SME platform ? which it launched on the same day when the BSE SME platform went live ? the trading activity has remained subdued.

Market participants, including merchant bankers and market makers, cite lot size constraints and lower free-float of the companies as the reason behind the lacklustre trading activity despite mandatory market-making for all stocks listed and traded on the SME exchanges.

Market participants, including merchant bankers and market makers, cite lot size constraints and lower free-float of the companies as the reason behind the lacklustre trading activity despite mandatory market-making for all stocks listed and traded on the SME exchanges.

?Unlike the main exchanges, investors on SME platforms are required to trade in multiples of the standard lot that amount to a minimum of R1 lakh. This has constrained the participation on the SME platforms even as market making is binding,? said B Madhuprasad, vice-chairman, Keynote Corporate Services.

Sebi stipulated rules for the standard lot size for SME ipos in February last year, which are also applicable to their secondary market trading. For example, it has fixed a minimum lot size of 10,000 shares for a SME stock that was offered at up to R14. For a company with a par-issue price of R10, the standard lot size would turn out to be 10,000 shares. It is believed that these norms were designed with an intent that informed investors like high net worth individuals, venture capitalists and private equity players would be the main participants on the platform.

?However, the performance of established companies amid a rising market has kept the interest of these investors subdued while the lower free-float has also worked as a deterrent,? said an investment banker.

The free-flow market capitalisation of companies like BCB Finance, Anshu?s Clothing, RCL Retail, SRG Housing Finance and Sangam Advisors stand between 32% and 35% of the total market cap, depicting higher promoter holding. Not surprisingly, the average trading volume on these counters has dipped by about 80-95% since the first day of listing. ?Market-makers can ensure availability of quotes for both buy and sell orders in case of investors looking for trade. However, given the limited nature of free float and profile of the investors on SME platform, their role remains restricted ,? said a broker.

Sebi has directed that market making has to be carried out for a period of three-years for all companies listed on the SME platform.