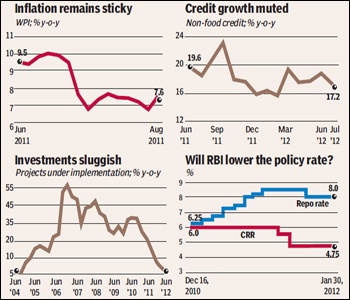

If only to support sentiment and revive growth, the Reserve Bank of India (RBI) may set aside its worries on inflation for the moment and lower the policy rate by more than a token 25 basis points on Monday. While inflation at 7.55% for August came in above expectations and can only trend up after Thursday?s diesel price hike, the central bank is expected to supplement the big bang reforms package unveiled by the Prime Minister and finance minister to revive growth.

India?s GDP in the three months to June grew a slightly better 5.5% year-on-year, higher than the 5.3% y-o-y seen in the March quarter, but factory output for July grew just 0.1% after contracting 1.8% in June. The underlying growth momentum remains sluggish led by weaker private consumption, investment and exports. Sources say the government?s concerns on stagnating investments ? the capital goods segment contracted 5% in July and between April and July has fallen 15.5% y-o-y ? may prompt the RBI to drop the key policy repo rate.

India?s GDP in the three months to June grew a slightly better 5.5% year-on-year, higher than the 5.3% y-o-y seen in the March quarter, but factory output for July grew just 0.1% after contracting 1.8% in June. The underlying growth momentum remains sluggish led by weaker private consumption, investment and exports. Sources say the government?s concerns on stagnating investments ? the capital goods segment contracted 5% in July and between April and July has fallen 15.5% y-o-y ? may prompt the RBI to drop the key policy repo rate.

The central bank has been calling for fiscal consolidation for some time now and the government?s move, last week, to increase the price of diesel by 12% would have been seen by it as a first step in this direction. Besides, the initiatives on the foreign direct investment (FDI) front would have been appreciated, although it could be a while before any meaningful money comes in.

The RBI last cut the policy rate by 50 basis points on April 17 this year, the first time in three years, bringing it down to 8%. Before that in March the central bank cut the cash reserve ratio (CRR) by 50 basis points in January and again by 75 basis points, infusing some R80,000 crore of liquidity into the system; liquidity in the banking system is now comfortable with demand for credit moderating.

As such several large banks have dropped deposit rates even though deposits have been hard to come by. Between April and now, the growth in loans has been more or less flat compared with the year-ago period, while deposits have grown some 6.5%. Demand from industry ? which accounts for about 45% of total loans ? is tapering off while demand from individuals is picking up with banks like State Bank of India having dropped rates on auto and home loans.